Maple SYRUP price eyes rebound as smart money piles in

Maple Finance price rose by 1.50% on Friday, as on-chain data showed that smart money investors were buying the recent dip.

Maple Finance (SYRUP) token climbed to $0.5365, slightly above this week’s low of $0.4912. It has surged over 520% from its lowest point this year, bringing its market capitalization to $638 million.

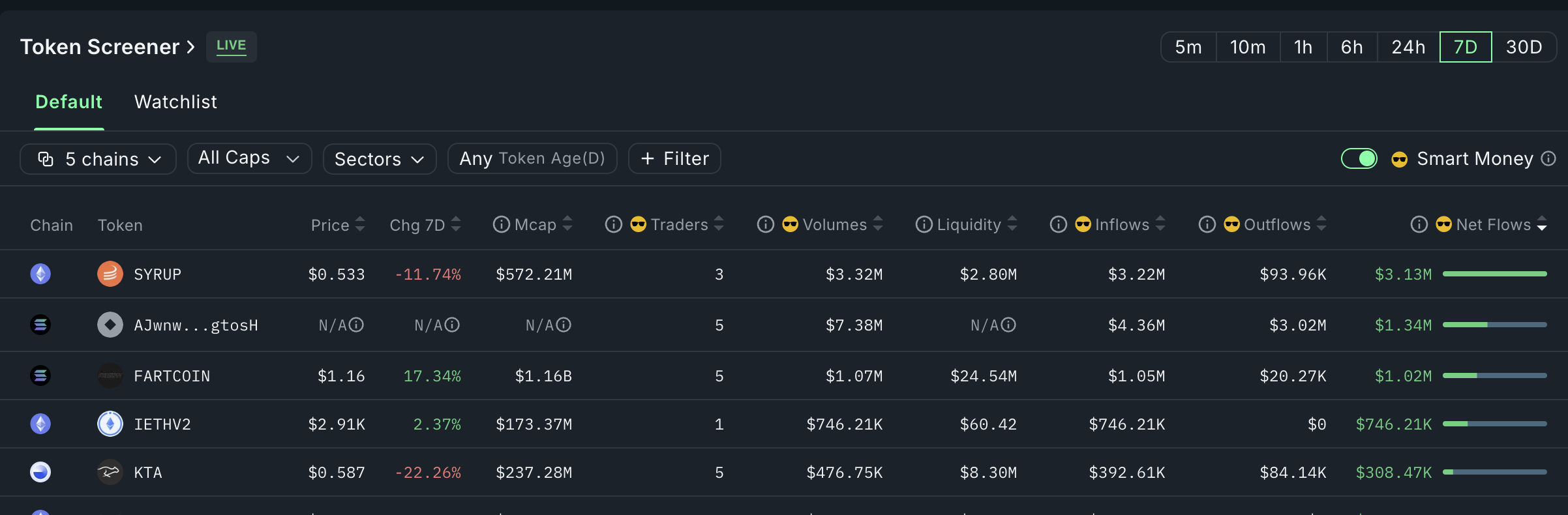

According to Nansen data, smart money investors have been accumulating SYRUP, indicating expectations of continued upside. These investors purchased tokens worth $3.13 million over the past seven days, making SYRUP the most bought token during this period.

Additional Nansen data shows that the top 100 addresses have increased their holdings by 10% in the last week, now totaling 1.07 billion tokens. Whale holdings also rose by 4% to 9.27 million, while the number of SYRUP tokens on exchanges dropped by 1.7% to 262 million.

Whales and smart money investors are likely buying because of its ongoing growth. Data show that the total value locked jumped to $2.8 billion, up from $540 million as of January 1.

Active loans on the platform now exceed $1.2 billion, while protocol revenue has surged. Maple Finance has already generated $4 million in revenue this year, well above the $2.5 million it earned for all of last year.

SYRUP price technical analysis

The daily chart shows that Maple Finance formed a double bottom at $0.089 in February and April. It broke above the neckline at $0.1930 in May and went parabolic as whales and smart money piled in.

SYRUP has moved above the 50-day moving average and formed an ascending channel. Also, the Relative Strength Index and the MACD indicators have continued rising.

Therefore, the coin will likely continue rising as bulls target the key resistance at $0.6575, its highest point this year. This price is about 22% above the current level. A move above that price will point to more gains to $1.

You May Also Like

Ethereum Foundation Converts $4.5M ETH to Stablecoins

Central Bank of Nigeria set to work on crypto regulation framework with the SEC, governor confirms