PA Daily | Doodles will launch the DOOD token; GameStop considers investing in Bitcoin and other cryptocurrencies

Today's news tips:

21,000 BTC options and 176,000 ETH options will expire today

GoPlus: Private keys of users of a trading platform or Trading Bot were stolen in batches, and more than $1 million in assets have been collected

Texas lawmakers resubmit Bitcoin Reserve Act to expand to include other cryptocurrencies

Michigan proposes to establish a Bitcoin reserve, becoming the 20th state to advance crypto reserve bill

GameStop Considers Investing in Bitcoin, Other Cryptocurrencies

Doodles announced that it will launch the official token DOOD on Solana, and 68% of the tokens will be allocated to the community

Coinbase's full-year revenue in 2024 will reach $6.6 billion, with a net profit of $2.6 billion

A sniper quickly bought Broccoli after CZ announced the dog's name and made a profit of $27.8 million

Regulatory/Macro

GoPlus: Private keys of users of a trading platform or Trading Bot were stolen in batches, and more than $1 million in assets have been collected

According to feedback from GoPlus users, some assets are suspected to have been stolen. Security monitoring shows that the stolen currency address was newly created yesterday, and more than 1 million US dollars of assets have been collected to the address starting with 0x49ad. GoPlus speculates that this may be related to the batch theft of private keys of users of a certain trading platform or Trading Bot. GoPlus reminds users to check the security of their wallet assets as soon as possible.

Texas lawmakers resubmit Bitcoin Reserve Act to expand to include other cryptocurrencies

Texas lawmakers have reintroduced a bill to establish a strategic Bitcoin reserve, now designated SB 21, which allows investments in additional cryptocurrencies. Senator Charles Schwertner announced the bill on February 12, emphasizing that it would make the state the first to establish a cryptocurrency reserve, potentially promoting innovation and "financial freedom." The new legislation builds on SB 778, an old bill introduced in January that focused on Bitcoin. SB 778 restricted state governments to buying and holding Bitcoin and not using it for other operations, while SB 21 expands the scope to allow investments in cryptocurrencies that maintain a market value of at least $500 billion over the course of a year. However, Bitcoin is currently the only cryptocurrency that meets this criterion.

Michigan proposes to establish a Bitcoin reserve, becoming the 20th state to advance crypto reserve bill

According to Cointelegraph, Michigan has become the latest state in the United States to propose a Bitcoin reserve bill, marking that 20 states across the country are advancing legislation on crypto reserves. On February 13, 2025, Congressmen Bryan Posthumus and Ron Robinson submitted HB 4087, which aims to amend Michigan's Management and Budget Act to establish a strategic Bitcoin reserve for the state government. The bill allows the Michigan Treasurer to invest in cryptocurrencies from the general fund and the Economic Stabilization Fund, with a maximum of 10%, and does not restrict or guide the types of cryptocurrencies that can be purchased. The bill also proposes that if cryptocurrency lending does not increase financial risks, the Secretary of the Treasury may lend cryptocurrencies for further gains. In addition, Posthumus also mentioned the launch of a stablecoin called "MichCoin", which will be linked to gold and silver reserves to enhance its actual value.

US Vice President threatens sanctions and possible military action if Russia doesn't reach peace deal

According to the Wall Street Journal: U.S. Vice President Cyrus Vance said on Thursday that the United States would impose sanctions on Russia and possibly take military action if Russian President Vladimir Putin does not agree to a peace deal with Ukraine that guarantees Ukraine's long-term independence. If Russia fails to negotiate in good faith, the option of sending U.S. troops to Ukraine remains "on the table."

Tiktok has been relisted on the App Store and Google Play Store

According to Jinshi.com, Apple (AAPL.O): Tiktok has been re-listed on the App Store. Google: TikTok has been re-listed on the Google Play Store.

US court agrees to suspend Binance's legal dispute with SEC until April, both parties must submit reports by April 14

According to The Block, Amy Berman Jackson, a judge at the District Court for the District of Columbia, has approved the suspension of Binance's legal dispute with the U.S. Securities and Exchange Commission (SEC). The case will be postponed for 60 days, and both parties must submit a joint status report by April 14. Binance and the SEC filed an application on Monday to suspend the case on the grounds that the SEC's newly established cryptocurrency working group is developing a clearer regulatory framework. The working group is led by Hester Peirce, a commissioner appointed by Mark Uyeda, the new acting chairman of the SEC. She recently proposed cryptocurrency regulatory priorities, including classifying some tokens as non-securities.

GameStop Considers Investing in Bitcoin, Other Cryptocurrencies

According to CNBC, game retailer GameStop is exploring the possibility of investing in Bitcoin (BTC) and other crypto assets, and sources said the company is evaluating whether this investment strategy is suitable for its business. Influenced by this news, GameStop's stock price rose 20% in after-hours trading. However, the company has not yet made a final decision on whether to implement the plan. Last weekend, GameStop CEO Ryan Cohen posted a photo with MicroStrategy co-founder Michael Saylor on the X platform. Although Saylor did not participate in GameStop's crypto investment discussions, MicroStrategy has purchased billions of dollars in BTC in recent years and has become a major corporate holder. GameStop launched a crypto wallet business in 2022, but closed it in 2023 due to regulatory uncertainty. Currently, the company holds $4.6 billion in cash reserves and approved a new investment policy at the end of 2023, allowing management to invest in securities assets that meet guidelines.

SEC Accepts Grayscale XRP Trust Conversion ETF Application and Starts Review Process

According to Fox Business reporter Eleanor Terrett, the U.S. Securities and Exchange Commission (SEC) has officially accepted the 19b-4 application submitted by Grayscale and NYSE, intending to convert the Grayscale XRP Trust ($XRP Trust) into an exchange-traded fund (ETF). While this does not mean automatic approval, and there is no guarantee that the SEC will eventually agree to the application, this development shows that the SEC is more open to crypto ETFs, rather than directly refusing to consider such products. Previously, due to the SEC's tough stance, the exchange withdrew the Solana ($SOL) ETF application. However, the SEC's acceptance of the XRP ETF application indicates that crypto ETFs such as LTC, DOGE, SOL, and XRP may still be approved. The SEC is expected to publish the application to the Federal Register within a few days, when the 240-day approval window will officially open. In addition, XRP ETF applications from institutions such as Bitwise, 21Shares, Canary Funds, and WisdomTree are still awaiting processing by the SEC.

US SEC has confirmed that it has accepted the DOGE ETF application

The U.S. Securities and Exchange Commission (SEC) has confirmed the acceptance of the 19b-4 application submitted by Grayscale and the New York Stock Exchange to establish a DOGE ETF. SEC documents show that NYSE Arca has submitted a revised rule change application to the SEC to list and trade Grayscale Dogecoin Trust (GDOG) shares on its exchange. The trust fund is operated by Grayscale Investments and Coinbase Custody is responsible for the custody of Dogecoin (DOGE). The investment goal of the trust fund is to have its share value reflect the price of DOGE and rely on the CoinDesk Dogecoin Price Index (DCX) for pricing. Currently, the management fee of the trust is 2.5%. The application still requires SEC approval and public comment procedures.

Financing

DeFi.app Completes $4 Million in Funding, Total Valuation at $100 Million

According to The Block, DeFi trading platform DeFi.app raised another $4 million in the latest seed extension round of financing, maintaining a token valuation of $100 million. The financing was jointly participated by venture capital institutions and Cobie's Echo platform, of which Mechanism Capital, DCF Capital Partners, Balaji Srinivasan, Pentoshi and other institutions invested $2 million, and Echo's Comfy Capital and George Beall team contributed $2 million. So far, DeFi.app's total financing amount has reached $6 million. In addition, DeFi.app announced the official opening of public beta, providing "gas-free" cross-chain token exchange, decentralized asset management and fiat currency purchase functions, and plans to launch perpetual contract trading, yield farms and lending services in the future. The platform's previous closed beta has attracted 100,000 standby users and completed $60 million in trading volume. The goal is to attract hundreds of thousands of users in the next few months and drive daily trading volume to nine figures. DeFi.app plans to conduct a public token sale this month, selling 3% of the total supply of HOME tokens to non-US KYC-compliant users, also at a valuation of $100 million.

FrodoBots Completes $8 Million in Funding and Will Launch Crypto Robot Network BitRobot

According to the official announcement of FrodoBots, it has completed $8 million in financing and plans to launch the BitRobot network that combines encryption and robotics technology, focusing on promoting the development of Embodied AI. This round of financing was led by Protocol VC, with participation from Big Brain Holdings, Fabric, Zee Prime Capital, Tioga Capital, Sfermion, Solana Ventures, etc. At the same time, Solana co-founders Anatoly Yakovenko and Raj Gokal and several DePIN project founders participated in the investment.

AI

Apple plans to introduce AI features on iPhones in China by mid-2025

Market news: Apple (AAPL.O) plans to introduce AI features on iPhones in China by mid-2025. Apple (AAPL.O) is working to introduce its artificial intelligence (AI) features to China by the middle of this year, accelerating this complex task that requires software changes and reliance on local partners. According to people familiar with the matter, the iPhone maker has multiple teams in China and the United States dedicated to adapting the Apple Intelligence platform to the Chinese region, with the goal of launching it as early as May. (Jinshi)

Baidu's next-generation Wenxin model will be open source

According to Baidu's official WeChat account, Baidu announced that it will launch the Wenxin Big Model 4.5 series in the coming months and will officially open source on June 30. Ironically, Robin Li said last year that open source is actually a form of IQ tax. "When you think rationally about what value a big model can bring and at what cost, you will find that you should always choose a closed source model. Today, whether it is ChatGPT or Wenxin Yiyan, closed source models are definitely more powerful than open source models and have lower reasoning costs."

Project News

The “czs-dog” section has been removed from the Binance Wallet homepage

According to the Binance Wallet official page, the "czs-dog" section has been removed. Earlier news, Zhao Changpeng: I will not issue Meme coins myself, it depends on whether the community does so.

Binance launches the sixth phase of BNSOL Super Staking Project Pepe (PEPE)

Binance announced the launch of the sixth BNSOL Super Staking Event with its token partner Pepe (PEPE). During the event, users who hold BNSOL or stake SOL as BNSOL from 08:00 on February 17, 2025 to 07:59 on March 17, 2025 (Beijing time) will receive PEPE APR Boost reward airdrops, which are additional benefits on top of the BNSOL staking base APR.

Doodles announced that it will launch the official token DOOD on Solana, and 68% of the tokens will be allocated to the community

According to the official announcement of Doodles, the NFT project Doodles officially launched its official token $DOOD and plans to issue it on the Solana chain with a total supply of 10 billion tokens. In the future, it will support cross-chain to Base. 68% of the tokens will be allocated to the community, of which 30% will be allocated to the Doodles community, 25% will go to the ecological fund, 13% will be allocated to new members, 17% will be allocated to the team (1 year lock-up, 3 years vesting), 10% will be used as liquidity funds, and 5% will be reserved for the company. Doodles said that its ecosystem has covered animation, short films and global brand cooperation, and plans to build a long-term cultural movement through a decentralized model.

Coinbase's full-year revenue in 2024 will reach $6.6 billion, with a net profit of $2.6 billion

According to The Block, the US cryptocurrency exchange Coinbase announced its fourth quarter and full-year financial report for 2024, exceeding market expectations, with a significant increase in revenue and profits. The company's fourth-quarter revenue reached $2.3 billion, doubling year-on-year, $430 million higher than market expectations, and quarterly net profit was $579 million. Trading revenue increased by 172% year-on-year to $1.6 billion. Full-year revenue reached $6.6 billion, up 111% year-on-year from $3.1 billion in 2023, net profit reached $2.6 billion, and adjusted EBITDA was $3.3 billion. Q4 total revenue was $2.3 billion, trading revenue was $1.6 billion, and quarterly net profit was $1.3 billion. Coinbase currently holds $9.3 billion in USD resources, up from $8.2 billion in the previous quarter. In addition, stablecoin revenue was $226 million, slightly lower than $247 million in the previous quarter. Coinbase shares rose in after-hours trading, up 16% so far in 2025 and 112% over the past year, with a market value of more than $73 billion. The company said in its annual shareholder letter that the U.S. regulatory environment is improving, the government's crackdown on the cryptocurrency industry is ending, and future policies are expected to be more friendly. Coinbase recently sent letters to the Federal Reserve, FDIC, and OCC, urging clarification of crypto banking rules and an end to the "de-banking" of the industry. Since Q1 2025, Coinbase's transaction revenue has reached $750 million, and subscription and service revenue is expected to be between $685 million and $765 million.

Zhao Changpeng released photos of his pet dog Broccoli and their story

Binance founder Changpeng Zhao (CZ) released photos of his pet dog Broccoli and their story.

Coinbase International will launch Spx6900 and Kaspa perpetual contracts

According to the announcement of Coinbase International Exchange, the platform and Coinbase Advanced will support Spx6900 and Kaspa perpetual contracts, and the SPX-PERP and KAS-PERP markets will be open for trading at or after 17:30 Beijing time on February 20, 2025.

Viewpoint

Analysis: Bitcoin bull run may not be over yet, 200-week moving average trend shows bullish signal

According to TradingView data, Bitcoin's (BTC) 200-week simple moving average (SMA) is currently $44,200. Although it has reached an all-time high, it is still far below the 2021 bull market peak of $69,000. Historical data shows that bull markets usually end when the 200-week moving average rises to the high of the previous bull market. For example, the 2021 bull market ended when the 200-week moving average reached the 2017 high of $19,000, while the 2017 bull market ended when the moving average reached the 2013 high of $1,200.

The current BTC price fluctuates between $90,000 and $110,000. If the historical trend continues, this range may break out with a bullish trend. In addition, Deribit options market data also supports this view. According to Amberdata statistics, call options with a term of three months or longer are more expensive than put options, reflecting the market's expectation of rising prices. The current market price is $96,700, and the most popular option is a call option with a strike price of $120,000, with a notional open interest of more than $1.8 billion.

Important data

A sniper quickly bought Broccoli after CZ announced the dog's name and made a profit of $27.8 million

According to Lookonchain monitoring, a sniper made a profit of $27.8 million by sniping Broccoli, a meme coin named after CZ's dog. After CZ announced the name of his dog, the sniper quickly bought almost all Memecoins named Broccoli, and distributed the tokens to multiple wallets through the Disperse tool and then sold them. Subsequently, the sniper collected the BNB obtained from the sale of Broccoli to the wallet "0xe332...03f3" and exchanged all the BNB for USDT. In the end, the sniper earned a total of 27.8 million USDT.

A whale spent $5 million to buy Broccoli tokens and became the largest holder

According to Lookonchain monitoring, a whale investor bought $5 million worth of Broccoli (token address: 0x6d5...714). The investor spent a total of 7,431 BNB (about $5 million) and purchased 39.54 million Broccoli tokens at a price of $0.1264, becoming the largest holder of the token.

Ethereum ETH pledge ratio has dropped to 27%, the first decline since the peak of 29%

According to The Block, the Ethereum staking ratio has dropped to 27%, back to the level since July 2024, and the first decline since the peak of 29% at the end of 2024. Currently, 33.5 million ETH has been staked, continuing to support the security of the Ethereum network. Despite the decline in the staking ratio, liquid staking derivatives (LSDs) still dominate the Ethereum ecosystem, with Lido controlling about 69% of the market share and Binance staking ETH accounting for 15% of the market share.

21,000 BTC options and 176,000 ETH options will expire today

According to Greeks.live data, 21,000 BTC options will expire today, with a Put Call Ratio of 0.67, a maximum pain point of $98,000, and a notional value of $2.08 billion; at the same time, 176,000 ETH options will expire, with a Put Call Ratio of 0.64, a maximum pain point of $2,725, and a notional value of $470 million. Despite the recent release of a number of positive news by the US government, market sentiment remains sluggish, with the implied volatility (IV) falling to its lowest level in nearly a year. Since BTC fell below $100,000, option tycoons have continued to sell short- and medium-term call options, with large call trading volumes rising but bearish trading volumes falling, indicating that the market is not optimistic about the rise, but the panic of falling is also weakening. Institutions generally believe that the market lacks funds and hot spots in February and may enter the "garbage time" stage.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

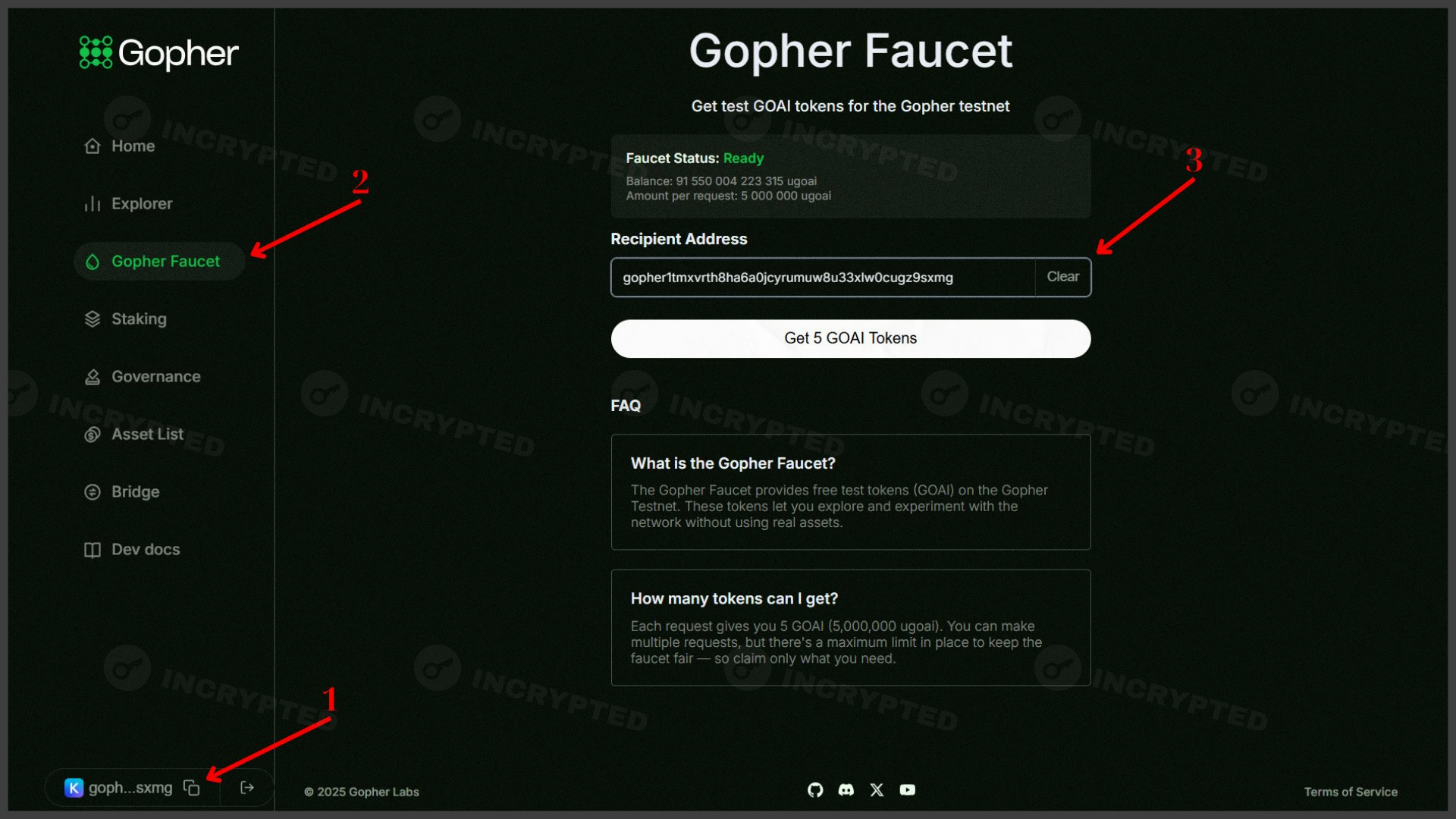

Gopher — active participation in the testnet with the aim of airdrop