PA Daily | GameStop plans to raise $1.3 billion to buy BTC; Upbit will list WAL

Today's news tips:

GameStop plans to raise $1.3 billion to buy Bitcoin

Hurun Global Rich List 2025: Musk retains title of world's richest man, Zhao Changpeng continues to be the richest man in the crypto field with a wealth of 160 billion yuan

US Senate passes repeal of controversial crypto tax rules, Trump expected to sign

Analysis: Binance Wallet is suspected to launch KiloEx token IDO

Upbit to List WAL in KRW, BTC, USDT Markets

Coinbase supports listing of ALT, PENDLE and L3

The top two vote-getters in Binance’s first voting are BANANAS31 and WHY

Deribit: Over $14.3 billion of BTC and ETH options will expire in Q1

Regulatory/Macro

More than half of the 20 hottest open source startups in 2024 are related to AI, and encryption projects such as MyShell and Fuel are on the list

According to the 2024 Runa Open Source Startup Index (ROSS Index) report released by European venture capital firm Runa Capital, more than half of the world's 20 hottest open source startups are closely related to AI. The index uses GitHub "star" growth as a measure to track the growth trend of commercial open source projects. Ollama, a Y Combinator-backed company that provides tools for running large language models (LLMs) locally, has increased its GitHub stars by 76,000, with a total of more than 135,000. Zed Industries ranked second, and its cross-platform collaborative code editor quickly gained 52,000 stars after being open sourced in 2024. LangGenius, the third-placed company, developed the LLM application platform Dify, with an annual growth rate of 326% and a total of more than 84,000 stars. In addition, ComfyUI and All Hands ranked in the top five with generative AI tools and developer agent platforms, respectively. The report also shows that although AI and LLM continue to dominate, developer tools and privacy protection self-hosted tools are also attracting attention. For example, Zed, Stirling PDF, and RustDesk all made the top 10. And the blockchain project Fuel shows that the crypto space is still alive and well.

Hurun Global Rich List 2025: Musk retains title of world's richest man, Zhao Changpeng continues to be the richest man in the crypto field with a wealth of 160 billion yuan

Hurun Research Institute released the "2025 Hurun Global Rich List", showing that the number of billionaires in the world has increased to 3,442, a record high, 163 more than last year. The United States ranks first with 870 billionaires, and China ranks second with 823. Elon Musk, 53, retained the title of the world's richest man with a fortune of 3.07 trillion yuan, an increase of 82%, mainly due to the surge in Tesla's stock price. Jeff Bezos of Amazon ranked second with 1.94 trillion yuan, and Mark Zuckerberg of Meta ranked among the top three for the first time with 1.77 trillion yuan. Nvidia's Huang Renxun's wealth nearly tripled to 935 billion yuan, ranking 11th. In the field of cryptocurrency, Binance founder Zhao Changpeng continued to rank first in the cryptocurrency field with a wealth of 160 billion yuan. Brian Armstrong of Coinbase increased his wealth by 72% to 80 billion yuan, and Michael Saylor of MicroStrategy nearly tripled his wealth to 65 billion yuan. The list also shows that entrepreneurs in the fields of AI, asset management, entertainment and cryptocurrency performed strongly, while luxury goods, telecommunications and Chinese real estate performed poorly. In the field of AI, Liang Wenfeng of Hangzhou DeepSeek and Sam Altman of OpenAI made their first appearance on the list with RMB 33 billion and RMB 13 billion respectively. In addition, Zhang Yiming of ByteDance became China's richest man with RMB 435 billion, surpassing "bottled water king" Zhong Shanshan.

South Korean court suspends three-month business restriction on Upbit

The Seoul Administrative Court of South Korea has ruled to temporarily suspend the "three-month partial business suspension" penalty imposed by the Financial Intelligence Analysis Unit (FIU) on Dunamu, the parent company of the crypto exchange Upbit. The court has approved Dunamu's administrative lawsuit and emergency suspension application, and the penalty will not be resumed until 30 days after the main case judgment takes effect. This means that new Upbit users can continue to deposit and withdraw crypto assets. Previously, the FIU accused Upbit of violating the Special Financial Law by trading with overseas unregistered exchanges without real-name verification.

US Senate passes repeal of controversial crypto tax rules, Trump expected to sign

According to The Block, the U.S. Senate passed a resolution by 70 votes to 28 to repeal the crypto tax regulations issued at the end of the Biden administration, and the bill will be submitted to President Trump for signature. The IRS DeFi broker rule requires some DeFi platforms to report user transaction information and issue 1099 forms as securities brokers, sparking privacy and compliance disputes. White House crypto adviser David Sacks said that the president's senior advisers will recommend signing the bill, which will become the first crypto legislation signed by Trump during his tenure. The DeFi industry welcomed the move, saying it would help protect innovation and technological development.

Interactive Brokers Adds Solana, Cardano, XRP, and Dogecoin to Its Crypto Trading Services

According to Bloomberg, Interactive Brokers announced that it has added four new cryptocurrency trading services: Solana, Cardano, XRP and Dogecoin. These currencies were previously named by Trump on the Truth Social platform and recommended to be included in the US crypto reserves, although the final executive order only covers Bitcoin. The new currencies will be provided through Zero Hash and Paxos, expanding customers' flexibility in crypto asset allocation. Interactive Brokers previously supported mainstream currencies such as BTC, ETH, LTC and BCH.

U.S. stocks closed: Nasdaq fell 2%, Nvidia fell more than 5%

U.S. stocks closed on Wednesday, with the Dow Jones Industrial Average initially closing down 0.3%, the S&P 500 closing down 1.1%, and the Nasdaq Composite Index closing down 2%. Tesla (TSLA.O) fell 5.5%, Nvidia (NVDA.O) fell 5.7%, Apple (AAPL.O) fell nearly 1%, and Trump Media Technology Group (DJT.O) fell more than 8%. Among blockchain concept stocks, MARA Holdings (MARA) fell 3.23%, Strategy (MSTR.O) fell 3.66%, and Coinbase (COIN.O) fell 5.03%.

Wyoming's stablecoin WYST enters critical testing phase, governor says it's expected to go live in July

According to an announcement issued by the Governor of Wyoming, the Wyoming Stablecoin Committee announced that its fiat-backed, fully-reserved WYST stablecoin has entered the multi-chain testing phase and has been deployed on test networks such as Avalanche, Solana, and Ethereum. WYST is issued by a public entity and is the first such project in the United States. Testing is expected to last until the second quarter of 2025, and it is planned to be officially launched in July. Partners include LayerZero and Stargate. WYST will be over-collateralized by cash and U.S. Treasury bonds, and the interest will be injected into the state education fund.

Viewpoint

Analysis: BTC has a 95% chance of not falling below $69,000, and the annual average price of $76,000 is considered an important support

According to Polymarket forecast data analysis, the target price of Bitcoin (BTC) in 2025 is $138,000, which still has about 60% room to rise from the current price. The analysis pointed out that although the recent crypto market has been affected by multiple unfavorable factors, BTC's bull market cycle may reach this goal by 2026. The analysis shared by user Ashwin shows that the BTC price forecast range is between $59,000 and $138,600, and the market sentiment is relatively conservative, mainly affected by macro uncertainties such as US trade tariffs. The average target price of Kalshi, a similar forecasting platform, is $122,000, slightly higher than the current historical high. In addition, market participants believe that BTC needs to hold key price areas to maintain the bull market, including the previous high of $73,800 and the peak of $69,000 in 2021. Analysis tools show that there is a 95% probability that BTC will not fall below $69,000, and the average annual price of $76,000 is also seen as an important support.

Analysis: Binance Wallet is suspected to launch KiloEx token IDO

According to @ai_9684xtpa's monitoring, Binance Wallet is suspected to be about to launch a new coin IDO, and the transaction records show that it involves the BSC ecosystem's Perp DEX project KiloEx (token $KILO). According to analysis, this transaction called the same "Create IDO" method as the $PARTI token two days ago, and the relevant deployment time of $KILO was about 16 hours ago. The official has not yet responded to this.

Project News

Yescoin partner: The four members involved in the case have been released on bail, and they have always believed in their innocence during the 37 days in the detention center

Zhang Chi, a partner of TON ecosystem project Yescoin, posted on WeChat Moments that he had always believed that he and his team were innocent during the 37 days in the detention center. Currently, all four team members involved in the case have been denied arrest and are on bail. Earlier news reported that Zhang Chi, the founder of Yescoin, was taken away by the police due to a dispute between partners, and the case has been upgraded to a criminal case.

Binance will launch PAXG/USDT perpetual contract, supporting up to 75x leverage

Binance Futures announced that it will launch the PAXGUSDT perpetual contract. The contract will be officially launched at 18:30 on March 27, 2025 (GMT+8), supporting up to 75x leverage.

Upbit to List WAL in KRW, BTC, USDT Markets

According to the official announcement, South Korean cryptocurrency exchange Upbit will list Walrus (WAL) in the KRW, BTC, and USDT markets, and the start time of trading support will be announced later.

Harpie announces closure of all services, users need to disconnect wallets in time

Harpie, an on-chain firewall provider, announced that it has decided to shut down its services immediately and reminded users to disconnect their wallets from the Harpie RPC. Harpie said that it was unable to continue operating due to its failure to establish a sustainable business model, although it was committed to creating a "zero theft" crypto ecosystem. Harpie completed a $4.5 million seed round of financing led by Dragonfly Capital in 2022.

OKX will launch FLUID (Fluid) spot trading

According to the announcement of Ouyi, FLUID (FLUID) will be launched on March 27, 2025. Fluid is a DeFi protocol that integrates lending and DEX exchange functions into one product. The specific arrangements are as follows: • Deposit opening time: March 27 14:00 (UTC+8) • Call auction time: March 27 17:00 to 18:00 (UTC+8) • FLUID/USDT spot trading opening time: March 27 18:00 (UTC+8) • Withdrawal opening time: March 28 18:00 (UTC+8)

CZ: Fees and donations received by the BNB address will be used to support BSC community projects

CZ posted on the X platform that all BNB fees or donations received by his (personal) public address will be used to support BSC (BNB Chain) community projects, including direct purchases of tokens of related projects. In addition, he emphasized that other tokens received by this address will be ignored for a long time and will not be processed or operated. CZ believes that this move is the simplest way to support the BSC project.

Bithumb will list Walrus (WAL) Korean Won trading pairs and support Sui network

South Korean cryptocurrency exchange Bithumb announced that it will launch Walrus (WAL) Korean won trading pairs, supporting Sui network recharges (not supporting other networks). Deposits and withdrawals are expected to open at 7 pm on the same day, and trading will start at 8 pm (local time), depending on liquidity conditions.

Coinbase supports listing of ALT, PENDLE and L3

According to Coinbase Assets, Coinbase will list the Ethereum network (ERC-20) assets AltLayer (ALT), Pendle (PENDLE) and Layer3 (L3), and will open ALT-USD, PENDLE-USD and L3-USD trading pairs in stages at 0:00 am on March 28 (Beijing time) after liquidity conditions are met.

Coinbase will launch Freysa (FAI) trading

According to Coinbase Assets, Coinbase will list the Base chain asset Freysa (FAI) and start phased trading of the FAI-USD trading pair at 0:00 am (Beijing time) on March 28 after meeting liquidity conditions. The official reminds users not to transfer the asset through other networks, as trading may be restricted in some regions.

The top two vote-getters in Binance’s first voting are BANANAS31 and WHY

According to Binance Square, Binance's first "Vote to List" voting ended at 00:59 (Beijing time) on March 27. BNB chain project BANANAS31 ranked first with 19.4% of the votes, followed by WHY project with 18.8%, attracting a total of 185,436 votes. Binance emphasized that the voting results are for reference only, and the final listing of the coin still needs to go through the review process.

Important data

Deribit: Over $14.3 billion of BTC and ETH options will expire in Q1

According to Deribit official news, tomorrow (March 28, Friday) will usher in the largest option expiration date in the first quarter of this year, and it is expected that more than $14.3 billion of BTC and ETH options will expire at 16:00 Beijing time. Among them, the nominal value of BTC options is $12.17 billion, the Put/Call ratio is 0.48, and the maximum pain point price is $85,000; the nominal value of ETH options is $2.15 billion, the Put/Call ratio is 0.39, and the maximum pain point price is $2,400.

In the second quarter of last year, 29 banks around the world held approximately $368.3 billion in crypto assets, but spot assets accounted for less than 3%.

According to data released by the Basel Committee on Banking Supervision (BCBS) cited by CoinDesk, the total amount of crypto assets held by 29 banks worldwide in the second quarter of 2024 reached 341.5 billion euros (about 368.3 billion U.S. dollars), of which only 2.46% were spot crypto assets. Compared with 2021, banks' spot crypto holdings have fallen by 44%. Data shows that banks are more inclined to invest in crypto-related exchange-traded products (ETPs), accounting for 92.5%, to avoid high volatility and regulatory risks. BCBS recommends that banks' spot crypto asset exposure should not exceed 2%.

Early PEPE giant whale qianbaidu.eth withdrew its tokens again, holding nearly 700 billion tokens

According to Spot On Chain monitoring, qianbaidu.eth, a giant whale that once made a profit of $7.34 million from PEPE, withdrew 506.2 billion PEPE (about $4.4 million) from Binance about 10 hours ago. Its current position is 699.8 billion PEPE (about $5.11 million), with a floating profit of $164,000, an increase of 2.8%. This address is one of the early buyers of PEPE and has achieved a 110% return rate.

Vitalik transferred 250 ETH to the privacy protocol RAILGUN this morning

According to on-chain analyst Ember, Ethereum co-founder Vitalik Buterin transferred 250 ETH (about $500,000) to the privacy protocol RAILGUN early this morning. Ethereum co-founder Vitalik Buterin has used the protocol to transfer funds many times before, and has said that most of these funds are used for charitable donations. RAILGUN supports on-chain privacy transactions, allowing users to manage assets without exposing their addresses.

Financing

Tether acquires 30% stake in Italian media company Be Water

According to Bloomberg, stablecoin issuer Tether will spend about 10 million euros to acquire a 30% stake in Italian media company Be Water. Be Water includes podcast production companies Chora Media and Will Media and film and television production and distribution company Be Water Film. The transaction is part of Tether's recent investment boom, and it has previously been involved in agriculture, AI, brain-computer interfaces and other fields. Tether's current USDT market value is about 144 billion US dollars, mainly supported by highly liquid assets such as US Treasuries.

OpenAI is close to completing a $40 billion round led by SoftBank, with a valuation of $300 billion

According to Bloomberg, OpenAI is close to completing a round of financing of up to $40 billion, with a valuation of $300 billion, setting a record for the largest financing in history. The round of financing was led by SoftBank Group, and other participants included Magnetar Capital, Coatue Management, Founders Fund and Altimeter Capital. SoftBank will invest a total of approximately $30 billion in two phases, with an investment of $7.5 billion in the first phase. This move has significantly increased the basis of OpenAI's valuation of $157 billion in October last year.

GameStop plans to raise $1.3 billion to buy Bitcoin

According to Bloomberg, GameStop announced on Wednesday that it plans to privately place $1.3 billion in convertible senior notes due in 2030. In addition, the company said it would allow initial purchasers to purchase notes with a total principal amount of no more than $200 million. GameStop said in a statement: "The company hopes to use the net proceeds from this offering for general corporate purposes, including the acquisition of Bitcoin in a manner consistent with GameStop's investment policy." Earlier this week, GameStop announced that it would include Bitcoin in its reserve assets.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

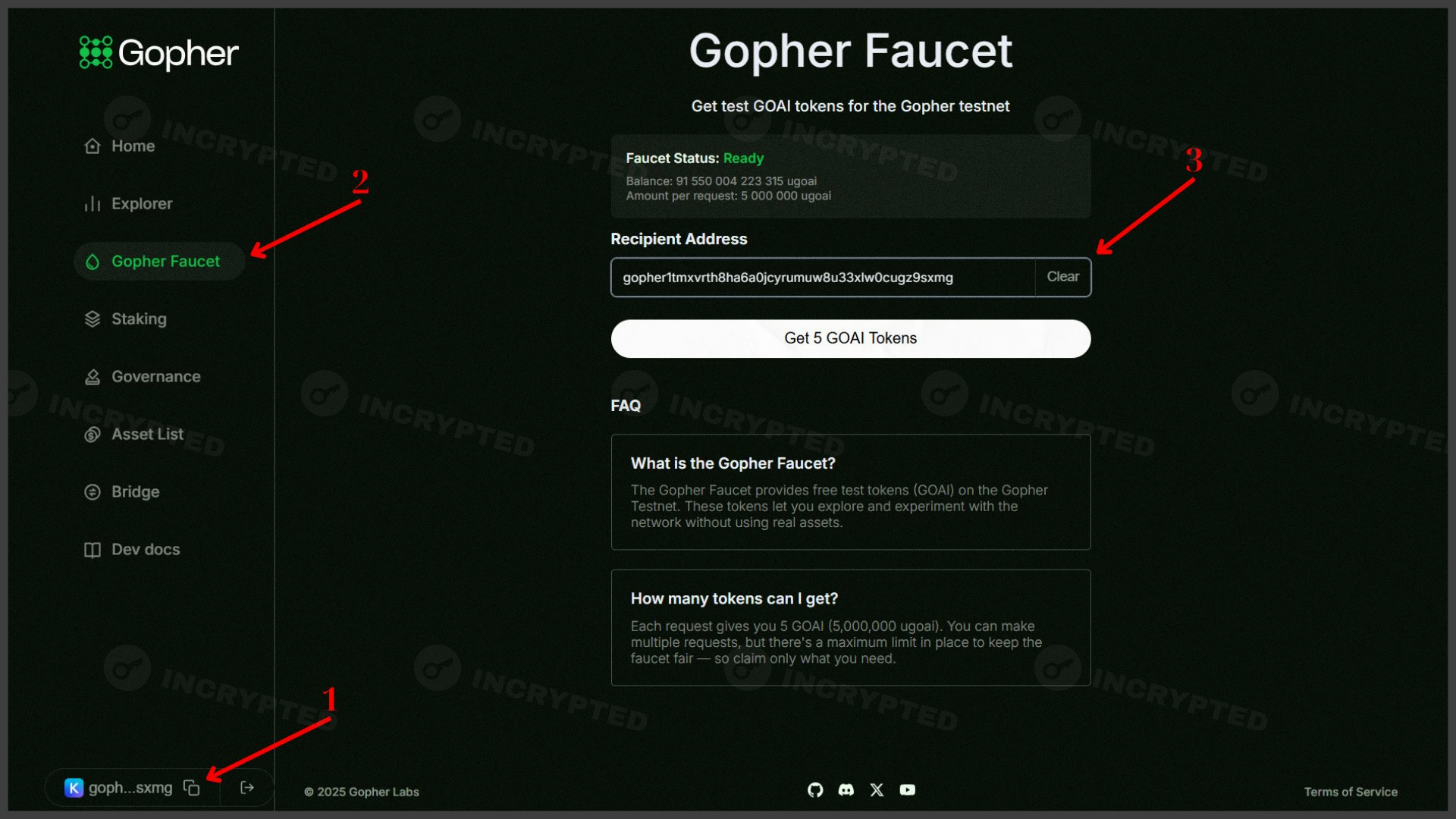

Gopher — active participation in the testnet with the aim of airdrop