PA Daily | Trump signs cryptocurrency executive order; Binance will launch VINE and PIPPIN perpetual contracts

Today's news tips:

The US SEC has officially revoked the crypto accounting policy SAB 121

Trump signs cryptocurrency executive order: evaluating the creation of a national digital asset reserve and banning CBDC

Trump: America will become the global capital of artificial intelligence and cryptocurrency

Binance will launch VINEUSDT and PIPPINUSDT perpetual contracts

OKX will launch ARC, SWARMS and COOKIE perpetual contracts

Market news: THORChain is in a debt repayment crisis and the verification nodes have suspended network operations, and are voting on the restructuring plan

Bithumb to List AERO and SOLVE in Korean Won Market

Changpeng Zhao: I have never bought Meme coins or NFTs, but that doesn’t mean I am against them

Regulatory/Macro

Scammers took advantage of Trump's TRUMP token hype and stole more than $857 million through 4 fake tokens

According to Beincrypto, scammers took advantage of the popularity of Trump's TRUMP token issued last week to send fake coins to wallets associated with the TRUMP team and its creators, causing cryptocurrency traders who closely followed these wallets to mistakenly purchase these worthless tokens. They thought the Trump meme coin team intended to buy these tokens and had insider information. Scammers anticipated this behavior and profited from it. According to Global Ledger data, four Trump-related scam tokens have generated at least $857.5 million in revenue. These tokens - JMilei, MELON, WTRUMP and PUTIN - have been cashed out on multiple major exchanges. Further investigation found that the three tokens PUTIN, KING and BUFFET were associated with the same deposit wallet on Binance. These wallets withdrew a total of $91.3 million. This pattern suggests that the same entity or group may have created and cashed out these tokens.

A Republican lawmaker is proposing a constitutional amendment to allow Trump to run for a third term

According to a tweet by American political commentator Brian Tyler Cohen on the X platform, Republican Congressman Andy Ogles is currently proposing a constitutional amendment to allow Trump to run for a third term.

The US SEC has officially revoked the crypto accounting policy SAB 121

According to the official website, the U.S. Securities and Exchange Commission (SEC) announced the withdrawal of crypto accounting policy SAB 121 in the latest employee accounting announcement No. 122. The document withdraws the explanatory guidance contained in Topic 5.FF, entitled "Accounting for the obligation of an entity to protect crypto assets held by its platform users." Entities should withdraw Topic 5.FF in a fully retroactive manner during the annual period beginning after December 15, 2024. In addition, the SEC emphasized that entities should continue to be obliged to disclose risks related to the custody of crypto assets in accordance with existing regulations.

Trump signs cryptocurrency executive order: evaluating the creation of a national digital asset reserve and banning CBDC

According to Fox Business News, Trump signed an executive order to establish the Presidential Digital Asset Market Task Force, which is tasked with developing a federal regulatory framework for managing digital assets (including stablecoins) and evaluating the creation of a strategic national digital asset reserve. The task force will be chaired by David Sacks, the "AI and Cryptocurrency Tsar" of the White House, and will include the Secretary of the Treasury, the Chairman of the SEC, and the heads of other relevant departments and agencies. The executive order instructs departments to make recommendations to the task force on any regulations and other agency actions that affect the digital asset sector that should be revoked or modified. In addition, the executive order prohibits agencies from taking any action to establish, issue, or promote central bank digital currencies (CBDCs). The executive order also revoked the previous administration's "Digital Assets Executive Order" and the Treasury Department's "International Engagement Framework for Digital Assets," saying that the two executive orders suppressed innovation and undermined the United States' economic freedom and global leadership in digital finance.

Financing

Decentralized Autonomous AI Agent Network MinionLab Completes $2 Million Pre-Seed Round of Financing

MinionLab, a decentralized autonomous AI agent network, has completed a $2 million Pre-Seed round of financing, led by Jsquare and Capital6 Eagle.

The funds will be used to expand the Minion network. MinionLab will launch more Minions to a wider user base to ensure wider coverage and more diverse data collection; the AI module team will develop specialized modules to solve tasks such as multi-step website navigation, advanced data extraction and other complex use cases; and develop the ecosystem through cooperation with AI startups, research institutions and mature companies. It is reported that Minions are autonomous AI agents running on user devices. Earlier news, the decentralized autonomous AI agent network All Stream AI announced that it was officially renamed MinionLab.

Bitcoin payments startup Breez raises $5 million

Bitcoin payment startup Breez announced the completion of a $5 million financing round, with participation from Entrée Capital, ego death capital, Plan ₿ Fund and Timechain. According to reports, Breez aims to introduce Bitcoin payment capabilities to every application, and in the 18 months since its launch, more than 40 applications have implemented the Breez SDK in production or testing. The company is also preparing to launch Misty Breez, a reference application that showcases a user-friendly Lightning UX through its nodeless implementation and SDK.

Solana Ecosystem Crypto Derivatives Exchange Ranger Protocol Completes $1.9 Million in Financing

Solana Ecosystem Crypto Derivatives Exchange Ranger Protocol has completed a $1.9 million financing round, led by RockawayX, with participation from Asymmetric, Big Brain Holdings, RISE Capital, Anagram and RockawayX. This round of financing was completed in December last year with a valuation of $30 million. Ranger Protocol co-founder Coby Lim said that the protocol is currently planning to add new product lines to enable customers to use AI-assisted trading strategies, and AI is expected to be launched in the "next few quarters."

Shared sequencer solution Radius completes $7 million seed round led by Pantera Capital

Radius, a shared sorter solution, announced the completion of a $7 million seed round of financing, led by Pantera Capital. According to reports, Radius is a trustless sorting layer that provides sorting as a service and cross-rollup interoperability solutions for specialized blockchains called rollups. In 2025, Radius will launch Lighthouse to help Rollups obtain MEV revenue. By 2026, Radius plans to expand on Ethereum to increase revenue opportunities.

Decentralized protocol Swarm Network completes $3 million seed round of financing

The decentralized protocol Swarm Network announced the completion of a $3 million seed round of financing, led by y2z Ventures and Zerostage. According to reports, Swarm Network is a decentralized protocol that converts raw off-chain data into verifiable on-chain information in real time. By integrating AI agents, human intelligence, and zero-knowledge proofs, it rewards integrity and promotes transparency.

AI

OpenAI releases its first AI agent tool Operator, which can perform web-based operations on behalf of users

According to Jinshi, OpenAI released its first AI agent tool Operator on Thursday, which can perform web-based operations on behalf of users. In addition, OpenAI founder Sam Altman said that the free version of ChatGPT will launch O3-mini.

Trump: Developing artificial intelligence requires doubling US energy supply

US President Trump: In order for artificial intelligence to reach the scale we expect, the United States needs to double its current energy supply. The energy emergency declaration is to speed up the US regulatory approval process. We will allow energy power plants to be built very quickly, and these power plants can use any required fuel. If (companies) produce products in the United States, the corporate tax rate will be reduced to 15%.

Trump: America will become the global capital of artificial intelligence and cryptocurrency

According to Solid Intel, US President Trump mentioned cryptocurrency in his latest speech and said that the United States will strive to become the world capital of artificial intelligence and cryptocurrency.

Project News

Binance will launch VINEUSDT and PIPPINUSDT perpetual contracts

Binance Futures announced the launch of USDⓈ-based VINEUSDT and PIPPINUSDT perpetual contracts, supporting up to 25x leverage. The specific opening time is: VINEUSDT perpetual contract will be launched at 18:00 (Beijing time) on January 24, 2025, and PIPPINUSDT perpetual contract will be launched at 18:15 (Beijing time). In addition, Vine Coin and Pippin have been launched on Binance Alpha Market.

OKX will launch ARC, SWARMS and COOKIE perpetual contracts

OKX announced that it will officially launch ARCUSDT, SWARMSUSDT and COOKIEUSDT perpetual contracts on the web, App and API from 19:00 to 19:30 on January 24, 2025. The specific opening time is: ARCUSDT contract trading opens at 19:00, SWARMSUSDT contract trading opens at 19:15, and COOKIEUSDT contract trading opens at 19:30.

Market news: THORChain is in a debt repayment crisis and the verification nodes have suspended network operations, and are voting on the restructuring plan

According to X user TCB, THORChain is currently insolvent. Data shows that THORChain's current liabilities include $97 million in loans (ETH and BTC) and about $102 million in savings and synthetic assets, while the available assets have only $107 million in external liquidity. TCB said that THORChain's lending obligations are fulfilled by minting and selling RUNE tokens, a design that leads to high reflexivity and further exacerbates the problem. After repaying $4 million in RUNE liabilities yesterday, the protocol owes millions of additional RUNE. The validator nodes have suspended network operations and are voting on a restructuring plan. THORChain faces two options: one is to maintain the status quo, about 5-7% of the value will be extracted by the first batch of exiters, and RUNE will continue to fall; the other is to declare a debt default, retain the valuable part through bankruptcy reorganization, and gradually repay creditors without affecting the feasibility of the protocol. TCB recommends the second option to maintain the value of the network and achieve long-term development by protecting the rights and interests of liquidity providers. According to the market, the price of THORChain (RUNE) is now $2.27, a 24-hour drop of 29%. Update: X user TCB released the latest explanation, saying that the THORChain network is still running, only the savings and loan functions are suspended.

Video Sharing Platform Rumble to Launch Rumble Wallet, Supporting Bitcoin and USDT

Chris Pavlovski, founder and CEO of Rumble, a video sharing platform invested by Tether, said on the X platform: "It has been confirmed that Rumble Wallet will be launched soon. This is a large internal project that creates a new way for creators to trade." The screenshots of the wallet released by him show that the balance of the wallet is displayed in the form of USDT and Bitcoin. In addition, the official X account of Rumble posted that creators will be able to receive tips and subscriptions in Rumble Wallet through BTC or USDT.

Blast and Arcade Research merge and launch Blast Mobile app

Ethereum Layer2 network Blast announced on the X platform that it is merging the operations of Arcade Research and the Blast Foundation into a streamlined structure managed by Pacman. In addition, Blast launched Blast Mobile and offers an annualized yield (APY) of over 50% in USD. Blast Mobile's income comes from Blast's own income (currently 11.5%, provided by Maker income) and BLAST rewards. Income is paid in BLAST, so the APY fluctuates according to market prices. Blast Mobile is the iOS of the cryptocurrency world. It allows users to use funds in apps without leaving their wallets or creating separate wallets for each app. First, apps created by Pacman and the Arcade Research team will be released. Then, more whitelisted apps will be gradually launched until the whitelist is finally lifted, and more apps are coming soon.

Bithumb to List AERO and SOLVE in Korean Won Market

According to an official announcement, South Korean crypto exchange Bithumb will list AERO and SOLVE in the Korean won market.

Pump.fun co-founded the eponymous meme coin ALON, and its market value once exceeded 260 million US dollars, but now it has fallen back to 140 million US dollars

GMGN data shows that the market value of ALON, the meme token of the same name by Pump.fun co-founder Alon Cohen, once exceeded $260 million, and has now fallen back to around $140 million. Earlier today, Pump.fun co-founder Alon Cohen said that he did not create the ALON token, but had taken over the token TG group and paid the Dexscreener fee.

Viewpoint

Changpeng Zhao: I have never bought Meme coins or NFTs, but that doesn’t mean I am against them

Zhao Changpeng posted on the X platform: "I can see the arguments on both sides. But I can't say I know which side is right and which side is wrong. I think the bottom line is that in a decentralized world, no one forces anyone to buy (or not buy) Meme tokens (or any cryptocurrency). If you don't want to, you don't have to participate. But others should have their own choices. I am a builder myself. I have not purchased Meme coins (or NFTs). But just because I don't understand how to appreciate something, it doesn't mean I am against them." In addition, Zhao Changpeng forwarded the guide "How to Issue Meme Coins on BNB Chain" and said that he could recommend a consulting team. Earlier in November last year, Zhao Changpeng said that he had no intention of cracking down on meme coin investment, but only hoped to encourage more developers to participate in the construction.

Vitalik: Stick to the route of expansion mainly through L2, and clearly think about the economics that can maintain the appreciation of ETH

Ethereum co-founder Vitalik Buterin published his latest blog post "Expansion of Ethereum L1 and L2 in 2025 and Beyond", pointing out that L2 currently faces two major challenges: 1. Expansion: Our blob space can hardly cover the current L2 and use cases, which is far from enough to meet future needs. 2. The challenge of heterogeneity: Each shard is created by different participants, and the infrastructure treats it as a different chain and usually follows different standards, which translates into composability and user experience problems for developers and users. Buterin said that abandoning L2 would sacrifice too many benefits of Ethereum's current social structure, so the current route should be adhered to, mainly through L2 expansion, but to ensure that L2 truly realizes the promises they are supposed to achieve. This means: 1. L1 needs to accelerate the expansion of blobs; 2. L1 also needs to moderately expand EVM and increase gas limits to handle the activities it will continue to have even in an L2-dominated world; 3. L2 needs to continue to improve security; 4. L2 and wallets need to accelerate improvements and standardize interoperability. 5.L2 deposit and withdrawal times need to become faster; 6.L2 heterogeneity is good as long as basic interoperability requirements are met; 7.The economics of ETH should be clearly thought about, and it is necessary to ensure that ETH can continue to increase in value even in an L2-dominated world, ideally solving various value-added models. The article mentioned that with the planned release of Pectra in March, it is planned to increase it to 6 blobs per slot. Regarding the economics of ETH, Buterin said that a multi-pronged strategy should be adopted to cover all major potential sources of value for ETH as a Triple Point asset (value storage asset, cash flow asset, consumable asset). Some key points of the strategy may include: 1. Broadly agree to establish ETH as the main asset of the larger (L1 + L2) Ethereum economy; 2. Encourage L2 to support ETH with a certain percentage of fees; 3. Support partial paths based on rollup; 4. Increase the number of blobs, consider setting a minimum blob price, and consider blobs as another possible source of income.

Riot Platforms executive: Ripple is actively lobbying US politicians to oppose Bitcoin strategic reserves

Pierre Rochard, vice president of research at Riot Platforms, wrote on the X platform: "The biggest obstacle to the Bitcoin strategic reserve is not the Federal Reserve, the Treasury, the banks, or Warren, but Ripple (XRP). Ripple is actively lobbying against the Bitcoin strategic reserve and has invested millions of dollars in politicians to try to hinder the plan. During the Biden administration, Ripple also attacked the Bitcoin mining industry in this way. Obviously, they want to protect their marketing effects and promote the implementation of CBDC based on this network."

Glassnode: Bitcoin's current trend is similar to the midpoint of the 2015-2018 cycle, indicating that growth is still continuing

According to Glassnode data, Bitcoin's current price trend is very similar to the patterns of previous market cycles, especially the 2015-2018 cycle, The Block reported. Glassnode's analysis of Bitcoin's historical market data highlights the significant growth in early cycles. The first cycle began with the genesis block in 2009 and ended in 2011, during which the price of Bitcoin increased by 80.51 times. The subsequent 2011-2015 cycle increased by 55.30 times. However, more recent cycles, such as 2015-2018 and 2018-2022, have more modest growth rates of 2.80 times and 3.31 times, respectively, reflecting the trend of diminishing returns as Bitcoin matures as an asset class. In its latest report, Glassnode pointed out that the growth of the current cycle is very close to the 2015-2018 cycle. In the corresponding stage of the 2015-2018 cycle, Bitcoin rose by 562%. Today, it has risen about 630% from its 2022 cycle low of $15,000, suggesting that further growth is possible. However, the size of future gains remains uncertain. Alvin Kan, COO of Bitget Wallet, made a speculative prediction that if Bitcoin could replicate the percentage gains of the 2015-2018 cycle, it could theoretically reach $1.7 million - an increase of 11,374% from the previous low. However, such predictions highlight the challenges of applying historical patterns to future scenarios. Kan said: While historical cycles provide valuable context, today's market environment is fundamentally different.

Vitalik warns: Political tokens are “a tool for unlimited political bribery”

According to The Block, Ethereum co-founder Vitalik Buterin posted on social media on Thursday that political tokens could lead to "unlimited" bribes. Buterin's comments are part of a broader discussion around trends in the cryptocurrency industry, especially in the context of political leaders such as US President Trump embracing cryptocurrencies. Buterin pointed out that some parts of the industry are in conflict with each other due to their short-term and long-term value, and compared it to "highly addictive mobile games" and chess. Buterin wrote on X: “Over the past year, we are entering a new order where the most powerful people in the world are now cheering the idea of anyone creating a token for anything at any scale. So it’s time to discuss the difference between short-term ‘sugar high’ fun that is not recommended to newbies, and long-term fulfillment and wealth accumulation. It’s not that ‘fun is bad,’ but rather similar to the difference between modern highly addictive mobile games and chess or World of Warcraft. It’s time to discuss the fact that large-scale political tokens cross another line: they are not just a source of fun, where harm is limited at most to mistakes made by willing participants, they are vehicles for unlimited political bribery, including from foreign governments.” Two recently announced large-scale political tokens are TRUMP and MELANIA, both of which are associated with President Trump and First Lady Melania Trump. Both tokens were launched before Trump was inaugurated as the 47th President of the United States on January 20, and experienced significant price drops shortly after.

Important data

Circle minted an additional 250 million USDC, bringing the total minted USDC to 3.5 billion in one week

According to Lookonchain monitoring, Circle minted 250 million USDC 14 minutes ago. In the past week, Circle has minted a total of 3.5 billion USDC on the Solana network.

The U.S. Bitcoin spot ETF had a total net inflow of $189 million yesterday, continuing its net inflow for 6 consecutive days

According to SoSoValue data, yesterday (January 23, Eastern Time), the total net inflow of Bitcoin spot ETFs was $189 million. Yesterday, Grayscale ETF GBTC had a net outflow of $49.9443 million in a single day, and the current historical net outflow of GBTC is $21.752 billion. Grayscale Bitcoin Mini Trust ETF BTC had a net inflow of $11.9045 million in a single day, and the current historical total net inflow of Grayscale Bitcoin Mini Trust BTC is $1.108 billion. The Bitcoin spot ETF with the largest net inflow in a single day yesterday was BlackRock ETF IBIT, with a net inflow of $155 million in a single day, and the current historical total net inflow of IBIT is $39.573 billion. The second is Bitwise ETF BITB, with a net inflow of $42.1475 million in a single day, and the current historical total net inflow of BITB is $2.431 billion. As of press time, the total net asset value of the Bitcoin spot ETF was US$121.599 billion, the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) was 5.94%, and the historical cumulative net inflow has reached US$39.420 billion.

A trader sold some of the ALON he bought for $2,500 in April last year and made a profit of $3.4 million

According to Lookonchain monitoring, a trader invested 2,500 USDC in April 2024 to buy 44.86 million ALON and has been holding it. In the past 4 hours, he sold 28 million ALON in exchange for 13,534 SOL (worth $3.41 million), earning a profit of $3.4 million.

Solana becomes the first blockchain in history to exceed $200 billion in monthly DEX transaction volume

Defillama data shows that the transaction volume of Solana ecosystem DEX reached 226 billion US dollars in the past month, making it the first blockchain in history whose DEX monthly transaction volume exceeded 200 billion US dollars.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

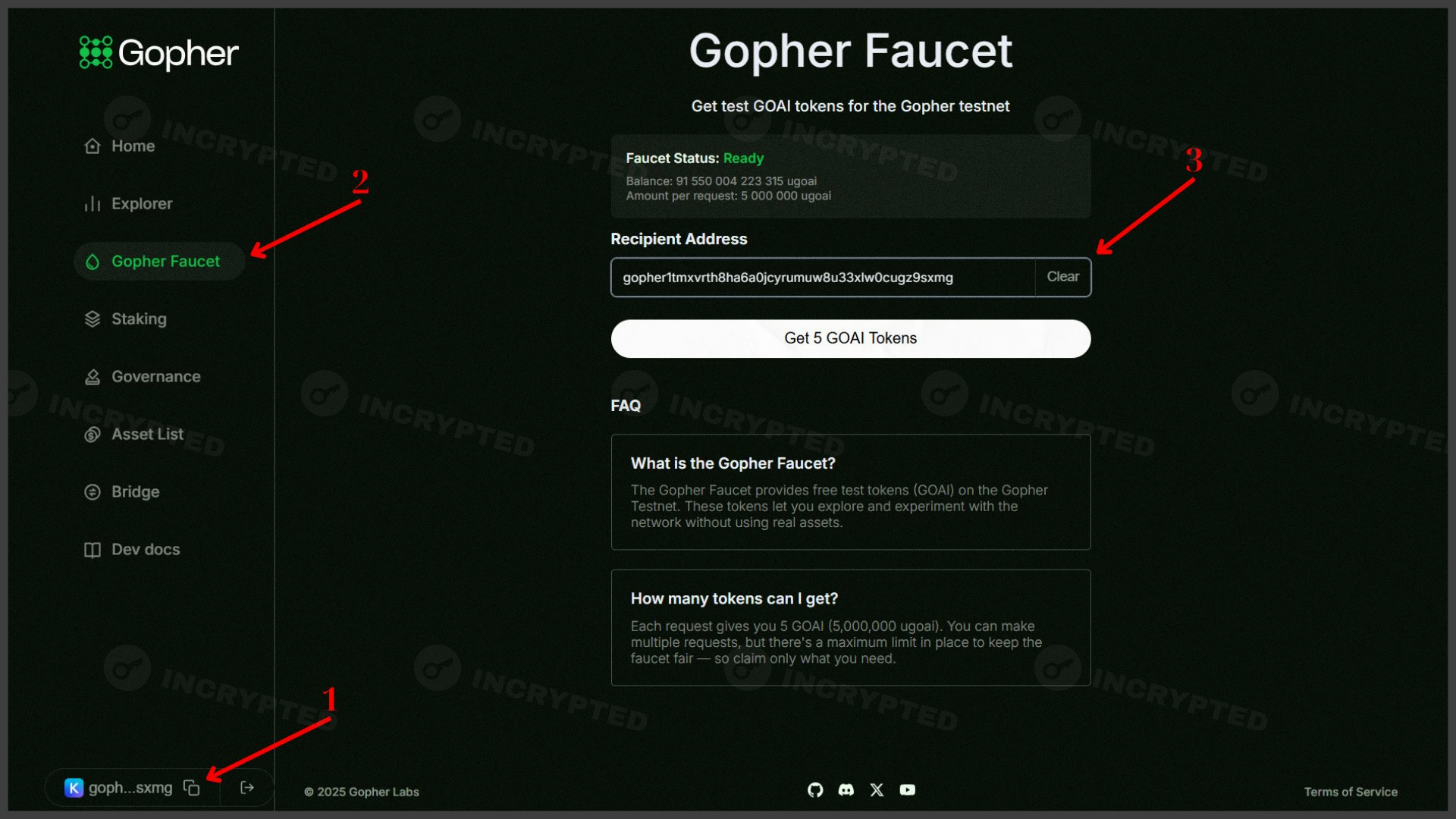

Gopher — active participation in the testnet with the aim of airdrop