Russian oil deliveries to China fall in 2025 despite July rebound

Russia remains China’s largest supplier of oil, but deliveries have gone down in 2025, amid global trade tensions and tariff threats from the United States.

Recent reports have indicated the trend is turning this summer but it’s yet to offset the notable drop in volume and even steeper decline in value registered by official Chinese stats.

Russian oil deliveries decrease in January-July

Russian Federation’s oil supplies to China fell by 7.6% year-on-year between January and July 2025, Russia’s TASS news agency reported on Wednesday, quoting Chinese data. During that time, the People’s Republic imported 57.71 million tons of Russian crude, as shown by the figures released by the General Administration of Customs of China (GACC).

According to the latest numbers published by the government body, the total was worth $29.48 billion. That’s 21.3% lower than in the same period of 2024, the report noted.

However, last month Moscow sent 8.7 million tons of oil to Beijing, which is 4.2% higher than the previous month. At $4.31 billion, the July deliveries were up by 9.2% in value over June.

The official Chinese numbers have come out after a report by Bloomberg unveiled this week that China almost doubled imports of Urals crude, the Russian export oil brand, in August, when compared to the 2025 average.

The increase follows a decline in India’s imports of Russian oil, after the U.S. administration of President Donald Trump slapped the country with tariffs over its energy purchases from Russia.

China, which was threatened with the same, has been spared for now, with Trump citing progress in negotiations with his Russian counterpart, Vladimir Putin, toward ending the war in Ukraine.

Russia continues to be the PRC’s largest supplier of the strategic energy resource, TASS remarked, recalling that last year Russian oil exports to China were up by 1.3% compared to 2022, reaching almost 108.5 million tons.

Russian gas supplies to China increase

The Russian Federation is also China’s biggest supplier of natural gas. Between January and July, the country exported $5.69 billion worth of pipeline gas to its neighbor. The Chinese customs did not reveal the volumes, but the value is 21.3% higher than the respective period of 2024.

Meanwhile, Russia’s supplies of liquefied natural gas (LNG) to China fell by 18.8% year-on-year, to 3.38 million tons in the first seven months of 2025. Their value decreased as well, again by 18.8%, to $1.98 billion. Russia is China’s fourth-largest supplier of LNG, after Australia, Qatar, and Malaysia.

Last year, the Asian nation imported pipeline gas for $21.1 billion, an 8.6% increase over 2023, with Russian deliveries rising by 25% to $8.03 billion.

Beijing also bought 76.64 million tons of LNG in 2024, which was 8% more than in 2023, and Russia shipped 8.3 million tons of it, a 3.3% increase in annual terms.

Overall, trade between China and Russia followed a similar trend to oil sales this year. It peaked amid Trump’s latest tariff threats, reaching its highest point for 2025 in July, as reported by Cryptopolitan. Last month put an end to its decline in H1.

Crude oil and natural gas, along with coal, form the largest share of Russia’s exports to its trading partner and political ally within the BRICS group. The rest includes other fuels as well as raw materials such as copper and timber.

The smartest crypto minds already read our newsletter. Want in? Join them.

You May Also Like

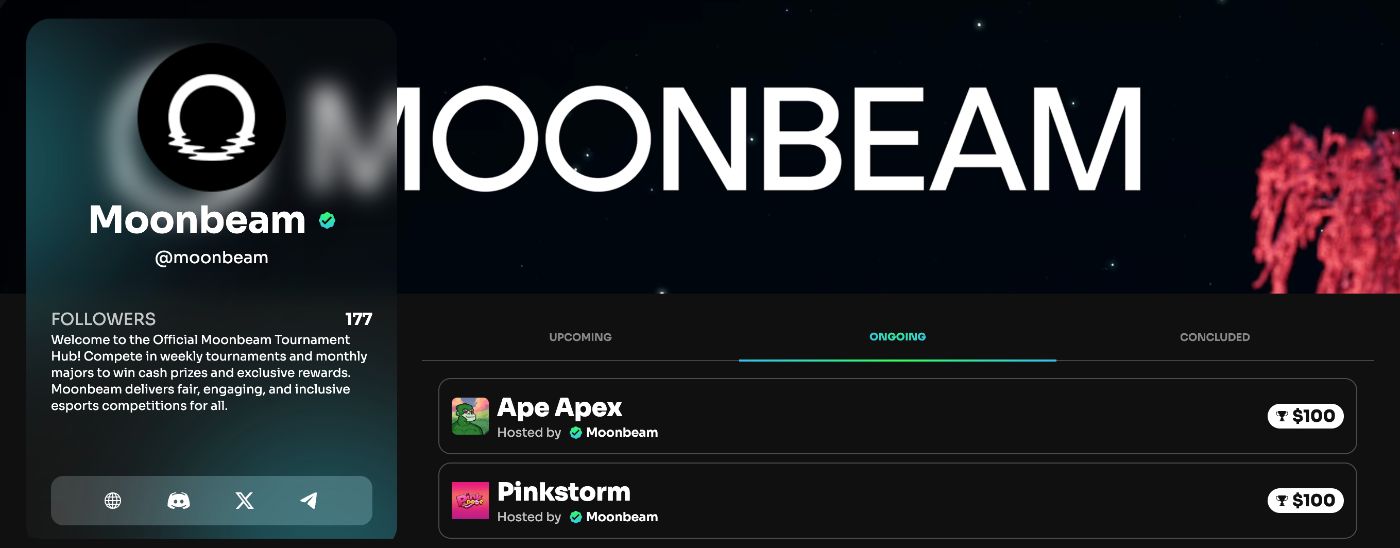

Why Web3 Gamers Are Rushing To Moondrop, Moonbeam’s GLMillionaire With 1,000,000 GLMR On The Line

Solana ETF Decision Delayed, Giving Mutuum Finance (MUTM) More Room to Eat into SOL’s Market Share