Solana (SOL) Price: Fresh ETF Filings Drive Token To New Highs Within Weeks

TLDR

- Solana (SOL) price rebounded above $210 after major asset managers filed fresh S-1 amendments for spot Solana ETFs

- Seven companies including Franklin, Fidelity, Grayscale, VanEck, and Bitwise submitted ETF filings with staking provisions

- Institutional inflows reached $16.2 million in one day through REXShares, showing professional investor confidence

- Technical analysis shows $230 as critical resistance, with potential targets of $370-$400 if broken

- Solana blockchain upgrades aim to remove fixed compute unit limits, potentially increasing network throughput

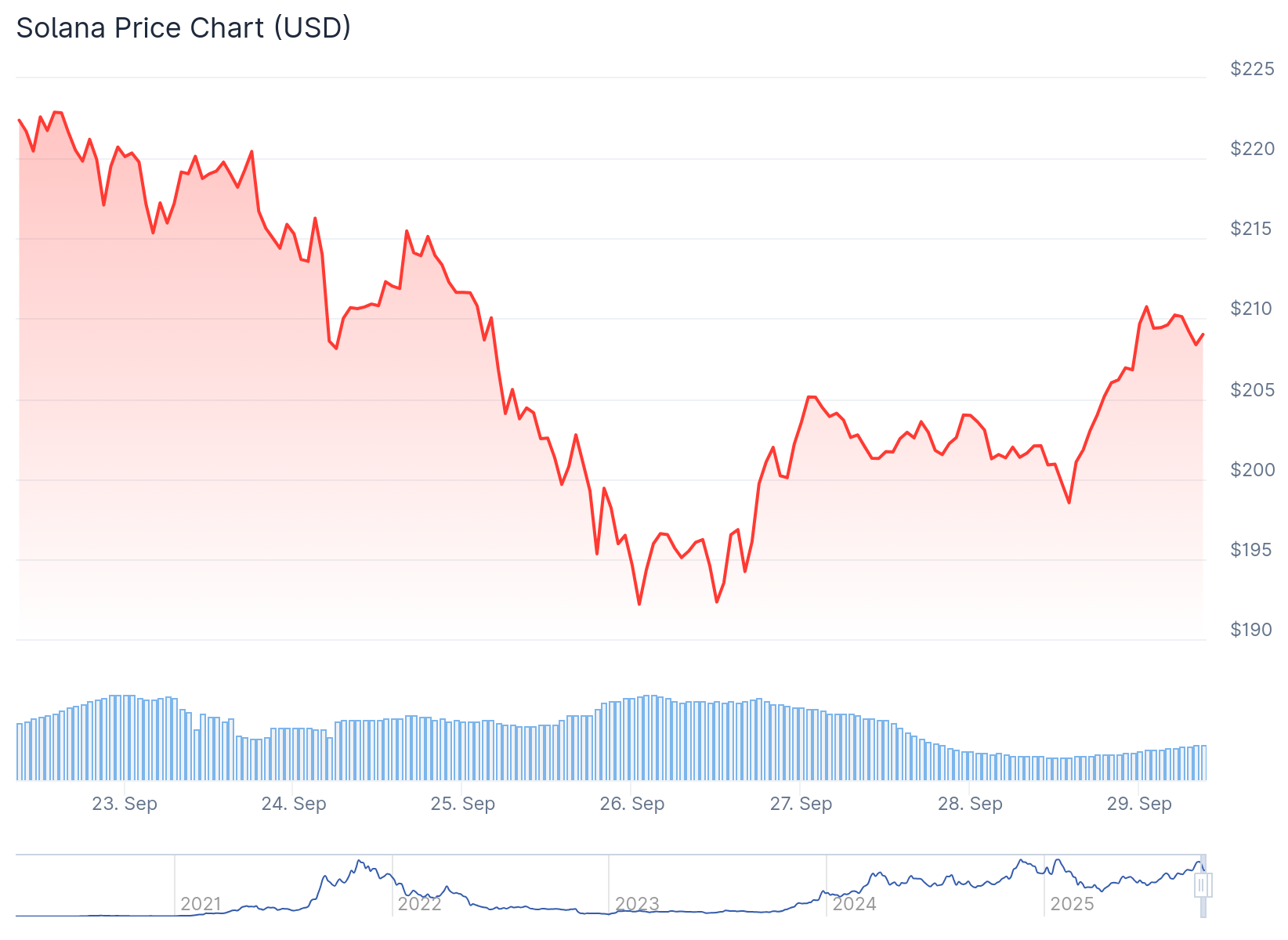

Solana price traded above $210 on Monday following a weekend rebound from key support levels. The recovery came after seven major asset managers filed fresh S-1 amendments for spot Solana exchange-traded funds.

Solana (SOL) Price

Solana (SOL) Price

ETF Store CEO Nate Geraci reported on Saturday that Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary submitted another round of amendments. The filings included staking provisions, which analysts viewed as positive for the broader crypto ETF market.

Geraci stated he expects approvals could arrive within two weeks. The announcement pushed SOL price up nearly 4% since Saturday.

The token found support around the 61.8% Fibonacci retracement level at $193.52 last week. It closed above the 50-day exponential moving average at $208.81 on Sunday before continuing higher.

Institutional Demand Provides Price Support

Institutional inflows have strengthened Solana’s price foundation in recent weeks. Data from SolanaFloor showed REXShares recorded $16.2 million in inflows during a single trading day.

This marked an extension of two weeks of steady institutional demand. Whale Insider reported that REX-Osprey funds purchased over $10.5 million worth of SOL tokens during the period.

Professional investors continued accumulating even during price weakness. Analysts interpreted the sustained inflows as confidence from institutional participants.

The consistent allocations provided liquidity and reduced volatility risks. Fund managers often view institutional flows as sentiment indicators that can stabilize price action.

ETF approvals would allow regulated access to Solana staking yields through traditional investment structures. Current products do not offer this feature, making the potential launches unique in the market.

Technical Outlook Points to Key Levels

Chart analysis identified $230 as the critical resistance level for Solana’s next move. A confirmed break above this point could open targets between $370 and $400.

Source: TradingView

Source: TradingView

The Relative Strength Index read 46 on the daily timeframe, pointing upward toward the neutral 50 level. This suggested fading bearish momentum in the near term.

Technical patterns showed a series of higher lows forming over recent weeks. Analysts viewed this as underlying strength despite the recent decline from September highs.

However, bearish scenarios remained possible if key support failed. Analyst Nebraskangooner highlighted a potential bearish setup on weekly charts.

A break below the $193.52 Fibonacci level could trigger declines toward $184.13. Some forecasts suggested deeper retreats to $160 if the $200-$206 support band failed to hold.

The divergence in technical outlooks reflected uncertainty at current price levels. Confirmation signals from either direction would likely determine the next trend phase.

Beyond ETF developments, Solana’s blockchain received technical upgrades. Jump’s Firedancer team introduced proposal SIMD-0370 to remove fixed compute unit block limits after the Alpenglow upgrade.

Current blocks have a static cap of 60 million compute units, set to increase to 100 million under existing proposals. The new framework would allow dynamic scaling based on validator performance rather than fixed constraints.

Block producers could pack more transactions while slower validators would skip blocks they cannot process. This creates incentives for hardware upgrades across the network.

The upgrade would allow Solana’s throughput to scale with validator capabilities rather than predetermined limits. Network capacity could increase as participants improve their infrastructure.

At press time, SOL traded near $210 with the 61.8% Fibonacci retracement level continuing to provide support from below.

The post Solana (SOL) Price: Fresh ETF Filings Drive Token To New Highs Within Weeks appeared first on CoinCentral.

You May Also Like

Nasdaq-listed crypto treasury GD Culture to add 7,500 BTC after Pallas Capital acquisition closes

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?