Solana (SOL) Price: Institutions Drive Buying Spree as SOL Eyes $300 Target

TLDR

- Solana broke above $180 with analysts targeting $245-$252 resistance zone

- 17 treasury firms now hold 17.1 million SOL, representing nearly 3% of total supply

- Galaxy Digital purchased additional 1.2 million SOL tokens, bringing holdings to 6.5 million

- Wrapped Bitcoin supply on Solana network reached all-time highs

- 85% of new crypto tokens (85 million out of 100 million) are now issued on Solana

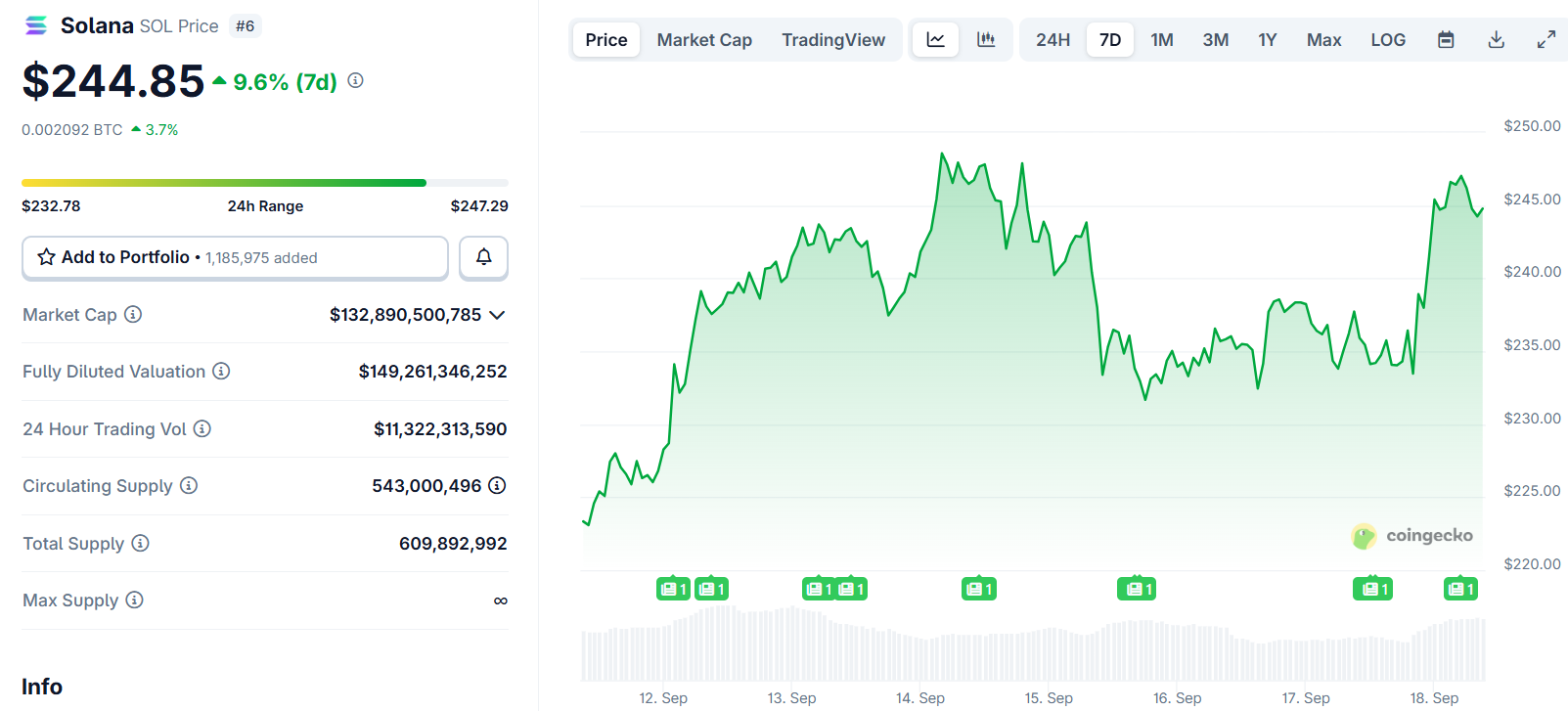

Solana price has broken above the $240 level after months of sideways movement. The cryptocurrency is drawing attention from both retail and institutional investors.

Solana (SOL) Price

Solana (SOL) Price

Multiple analysts are watching the mid-$240s to low-$250s range as the next resistance zone. This area sits between $245 and $252 according to current market analysis.

If Solana maintains support in the low-$230s, traders expect a move toward the $245-$252 range. A push beyond this level could target $260-$280.

A decisive weekly close above Solana’s previous all-time high near $294 would put the $300 area within reach. Coinpedia’s average forecast for 2025 sits around $325.

Some optimistic projections point to levels above $400. These forecasts depend on continued institutional adoption and network growth.

Institutional Money Flows Into Solana

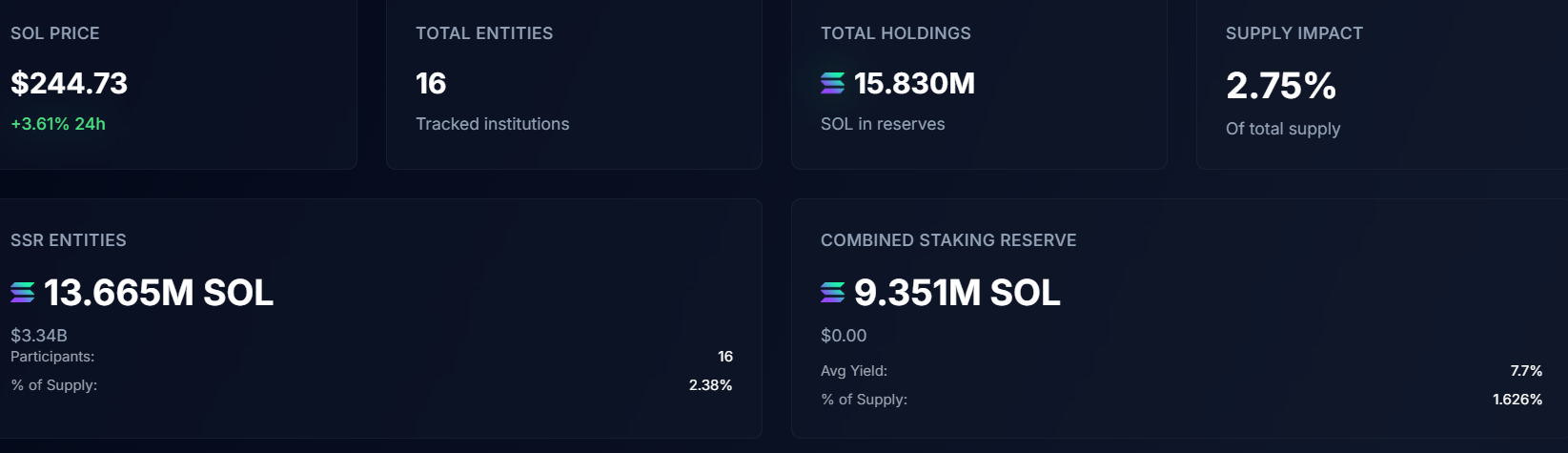

Treasury management firms are accumulating Solana tokens at record levels. Currently, 17 treasury firms hold 15.83 million SOL tokens combined.

Source: Solana Reserve

Source: Solana Reserve

This represents nearly 3% of Solana’s entire circulating supply. These institutions typically hold positions for longer periods rather than quick trades.

Forward Industries completed a $1.65 billion raise to purchase more SOL tokens. The company plans to deploy these tokens directly into Solana’s DeFi ecosystem.

Galaxy Digital, led by Mike Novogratz, purchased another 1.2 million SOL tokens on September 15. This brought Galaxy’s total holdings to approximately 6.5 million SOL.

Source: Lookonchain

Source: Lookonchain

Galaxy also helped Forward Industries complete its fundraising round. The firm’s continued accumulation shows confidence in Solana’s long-term prospects.

Network Activity Reaches New Heights

Stablecoin inflows to Solana are increasing rapidly. USDC and USDT supplies on the network continue growing.

These inflows indicate traders and projects are moving capital onto Solana. The fresh liquidity supports increased trading activity across the ecosystem.

Wrapped Bitcoin supply on Solana just hit an all-time high. This shows Bitcoin holders are bringing their assets to Solana for yield opportunities.

Cross-chain activity demonstrates confidence in Solana’s technology and security model. Bitcoin users are staking and trading through Solana protocols.

The integration creates deeper market connections between Bitcoin and Solana ecosystems. This cross-pollination brings additional capital to the network.

Token Launches Dominate Solana

Out of 100 million tokens issued across all major crypto networks, 85 million now exist on Solana. This represents 85% of all new token launches.

The tokens include stablecoins, memecoins, project tokens, and liquidity provider tokens. Solana’s low fees and high speed attract developers.

Each token launch represents developer activity and economic experimentation. New projects bring users and capital to the ecosystem.

Solana has become the preferred launchpad for DeFi protocols, NFT projects, and payment applications. The infrastructure supports rapid innovation cycles.

The network’s ultra-fast transaction speeds and minimal costs enable new use cases. This technical advantage drives continued adoption.

Galaxy Digital’s recent purchases and Forward Industries’ billion-dollar raise demonstrate institutional confidence. Treasury firms are making long-term bets on Solana’s infrastructure role in decentralized finance.

The post Solana (SOL) Price: Institutions Drive Buying Spree as SOL Eyes $300 Target appeared first on CoinCentral.

You May Also Like

Trump's stablecoin project USD1 has been listed on Aptos

What China Banning Nvidia Chips Means for the AI Race