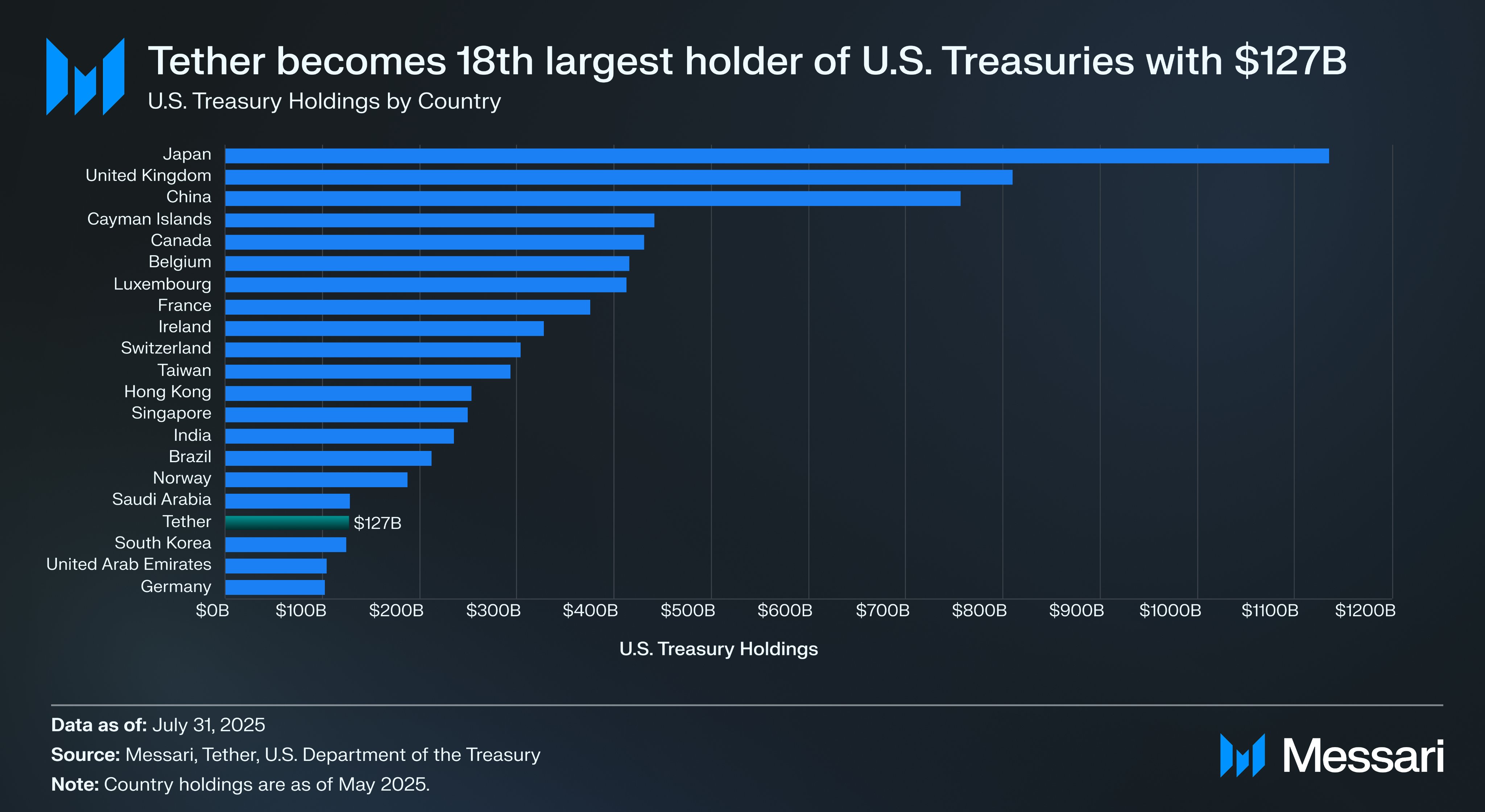

Tether beats South Korea as one of the largest U.S. treasury bond holder

Stablecoin issuer Tether has surpassed South Korea in the number of U.S. treasury bond holders after it issued more assets with total exposure to U.S. Treasuries. How much U.S. debt does the firm hold?

- Tether’s U.S. Treasury reserves surpass South Korea, Germany and United Arab Emirates.

- Tether continues to generate net profit, reaching $4.9 billion in Q2 2025 alone.

According to data from analysis firm Messari, the Paolo Ardoino-led company has climbed the ranks and surpassed three sovereign states in the number of U.S. treasury bonds it holds. On August 1, the firm was able to surpass South Korea, which currently holds less than $127 billion in bonds.

In Q2 2025, the USDT stablecoin issuer firm significantly expanded its holdings of U.S. government debt, reporting over $127 billion in U.S. Treasuries, including $105.5 billion in direct holdings and $21.3 billion indirectly. This marks an $8 billion increase from Q1 and boosts Tether’s position as one of the largest holders of U.S. debt globally, rivaling sovereign nations.

Based on Messari’s analysis, the stablecoin firm remains the only company on the list with more U.S. treasuries than other states mentioned on the list. Aside from South Korea, Tether (USDT) also holds more U.S. treasury bonds compared to the United Arab Emirates and Germany.

Both nations hold slightly more than $100 billion in U.S. debt respectively.

Tether’s reserves surpass liabilities in Q2

Aside from the milestone in U.S. treasury bonds held, the report also confirms that Tether’s reserves exceed its liabilities, with total assets at approximately $162.6 billion versus $157.1 billion in liabilities.

The company holds $5.47 billion in shareholder capital as a protective equity buffer, reinforcing its financial strength and solvency. More importantly, the $127 billion in U.S. Treasuries serves as the main backing for USD₮, ensuring high liquidity and low risk for token holders.

In the second quarter of 2025, USDT’s issuer generated a net profit of around $4.9 billion, driven by income from its U.S. Treasury holdings and strategic reserves in Bitcoin (BTC) and gold. Out of the $5.7 billion in total year-to-date profits, $3.1 billion came from stable recurring revenue, with the remaining $2.6 billion from mark-to-market gains.

This financial performance enables the firm to continually reinvest, with $4 billion already deployed in U.S. strategic initiatives, including projects like XXI Capital and Rumble Wallet.

You May Also Like

Including 2,373 ETH, 7.76 million ENA and 38.86 billion PEPE.

According to an official announcement, Coinbase will suspend trading of Function X (FX) on August 15 (approximately 2 PM EST) as the project team is still suspending the underlying smart contract for