Troll Football draws mixed reactions after Pump.fun meme token launch

Football memes X account Troll Football drew mixed reactions when it launched its first digital asset, a Solana-based token called FOOTBALL, through memecoin launchpad Pump.fun on Wednesday.

Troll Football is one of the most recognized meme pages in global football culture, with more than 4.8 million followers on X. The account claims over 100 million impressions per month and 2 billion total views in 2025.

Many tokens launched on Pump.fun often start anonymously or with little community backing, but observers have noted that FOOTBALL has a major meme brand behind it.

The launch is the first step of the project’s four-part roadmap that promises collaborations with professional players, brand tie-ins, and more additions from football culture.

FOOTBALL has community backing, project team says

According to its website, FOOTBALL takes the passion of football fandom to crypto markets as a sports-focused memecoin supported by an already-established global community.

Trading data from DEXScreener shows FOOTBALL surged after its launch, climbing to an early high of $0.0021. However, the token quickly retraced, falling back to around $0.00162 as of Thursday morning trading. The drop is approximately 22% from its peak price on the same day.

At press time, the token has a fully diluted valuation (FDV) of $1.6 million and a market capitalization of $1.6 million, with reported liquidity of around $167,000. Trading activity has recorded over 76,000 transactions and over $2 million in volume since it debuted.

Despite the price retracement in the last half hour, FOOTBALL has recorded a 438% increase in the past 24 hours, according to market tracking data, as early speculators moved in on the launch.

Troll Football outlines roadmap, but reception has been negative

Troll Football may have attempted to present FOOTBALL as a fan-driven token with mass appeal, but social media reactions have been largely on the negative side. Under the project’s announcement post on X, several users accused the account of being compromised or running a potential “rug pull.”

“You’re promoting a scam. I know they paid you,” one user wrote in a comment. Many others shared similar sentiments.

Concerns about scams have grown on Pump.fun, as the platform’s popularity has invited both genuine community-driven tokens and bad actors looking to exploit its ease of use.

Away from the backlash, Troll Football’s published roadmap shows the second phase after launch will see the project form partnerships with professional footballers and online personalities.

The third and last phase seeks to expand FOOTBALL into having more football culture through collaborations and global campaigns, leading the sports memecoin to top charts on the Solana network.

Pump.fun’s good and bad memecoin relationship

In a report released Wednesday, Galaxy Digital analyst Will Owens wrote that meme coins are now more than the Dogecoin internet jokes and have become a “cultural and economic force.”

Galaxy’s report stated that one of the reasons the market has witnessed this growth is because of Pump.fun, the Solana-based launchpad that allows anyone to create a token in minutes. Owens noted that the platform has “turbocharged activity in 2025,” contributing to record fee generation on the Solana network.

Commonly dubbed a “memecoin factory,” Pump.fun tools make token creation simple, fast, and inexpensive. But researchers and naysayers are bashing many tokens created on Pump.fun, saying most of them are offensive or extremist themes.

Of the top 15 trending tokens on DEXScreener this week, at least four referenced racial slurs or skin color.

Top ranking coins on Pump.fun. Source: DEXScreener

Top ranking coins on Pump.fun. Source: DEXScreener

Earlier this year, “Elon Hitler” and “Adolf Musk” tokens appeared merely hours after Tesla CEO Elon Musk’s salute during Donald Trump’s presidential inauguration. Netizens widely interpreted the name as a reference to the fascist symbolism of the Nazis.

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

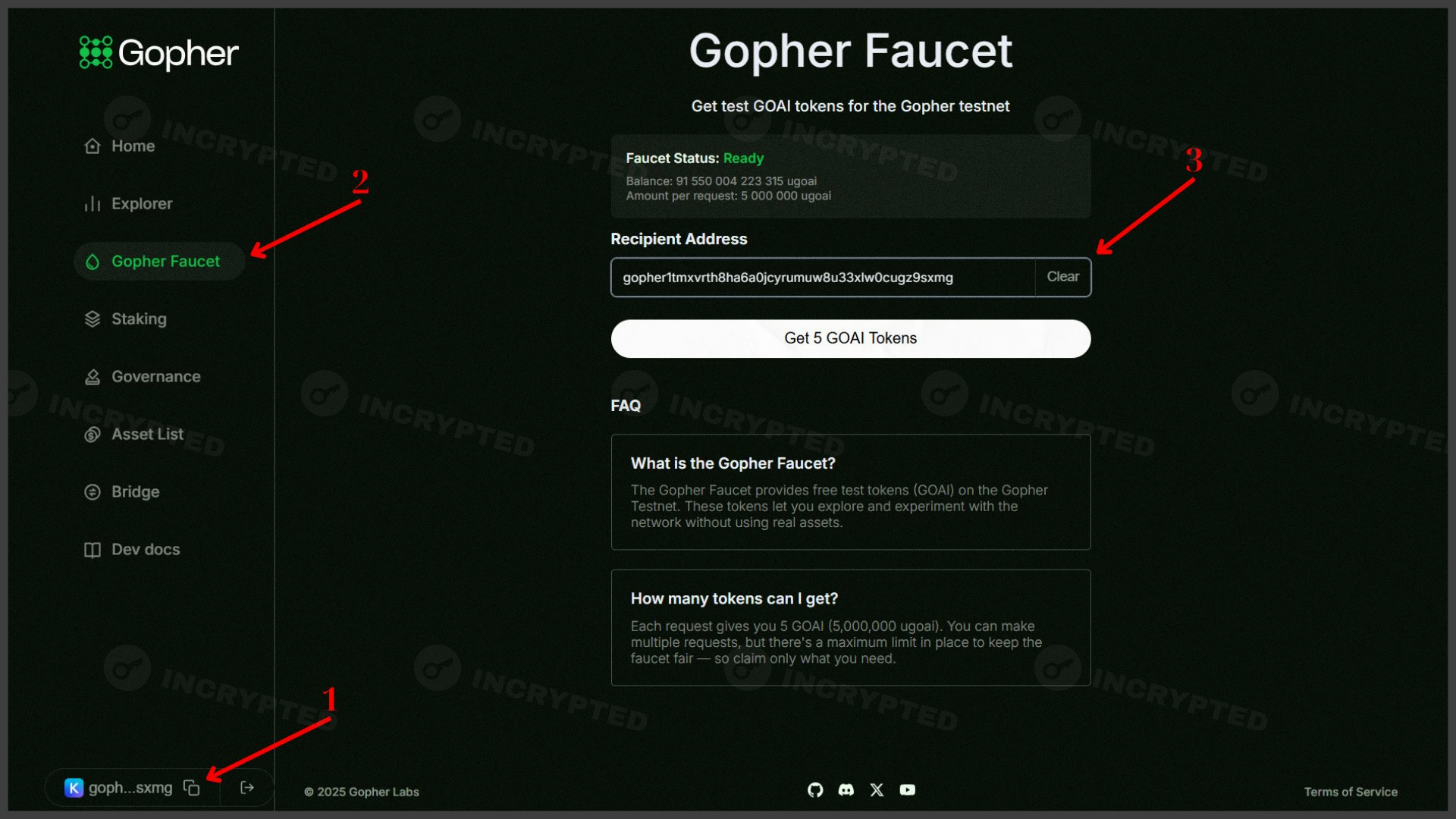

Gopher — active participation in the testnet with the aim of airdrop