U.S. Office of the Comptroller of the Currency: Banks can hold and use crypto assets to pay for blockchain networks.

PANews reported on November 19 that the U.S. Office of the Comptroller of the Currency (OCC) issued Explanation Letter 1186, confirming that national banks can hold and use crypto assets as principal to pay blockchain network fees (such as "gas fees") to support their legitimate operations. Furthermore, banks can also hold crypto assets for testing self-developed or third-party platforms. The OCC emphasized that such operations must be conducted in compliance with regulations and with sound business practices.

Fox News reporter Eleanor Terrett commented that two years ago, prudential regulators warned banks that directly issuing or holding public blockchain crypto assets was "highly likely not in line with sound banking practices." Now, the U.S. OCC has confirmed that banks can legally hold and use them to pay network fees, a significant change in the industry.

You May Also Like

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

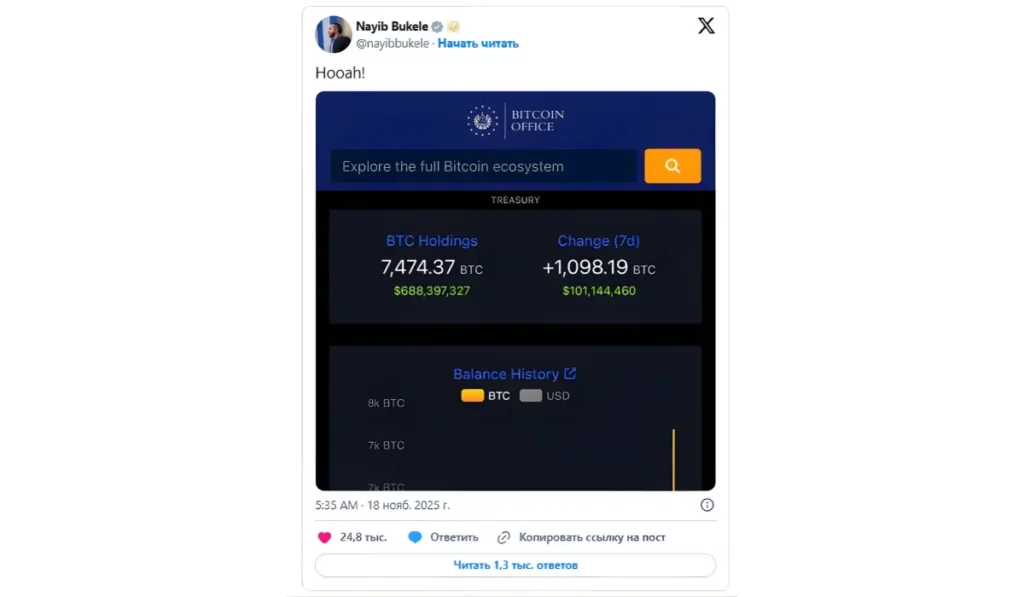

El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury