Whale shifts from Bitcoin to Ethereum: 4,000 BTC for 96,859 ETH, position at approximately $3.8 billion and spotlight on futures

A large on-chain entity has converted a significant portion of BTC into ETH, bringing the exposure in Ether to approximately $3.8 billion.

The move, reported by industry sources, reignites the theme of rotation from Bitcoin to Ethereum and puts the spotlight back on derivatives, open interest, and volatility. Initial reports of the event were covered by industry outlets like Cointelegraph and analyses on execution mechanisms by specialized financial media like CoinDesk.

According to the data collected by our on-chain team updated as of September 1, 2025, the monitored address has increased its exposure in ETH to the estimated figure of $3.8 billion.

Industry analysts we collaborate with observe that similar operations, executed in short time frames, tend to be structured through OTC channels and venues with market depth to limit slippage.

The professional trading desks consulted also report that spot movements of this magnitude immediately influence the monitoring of the basis and funding in the derivatives markets.

Key Data (reconciled)

- Main swap: 4,000 BTC → 96,859 ETH, executed within a window of approximately 12 hours, as reported by Cointelegraph and BitcoinEthereumNews.

- Estimated value of the single conversion: ~$435 million [data to be verified], calculation derived from reported market prices; the estimate may vary based on BTC/ETH quotations at the time of the transaction (update September 1, 2025).

- Total address exposure in ETH: ~$3.8 billion [data to be verified] (overall position, not related to a single transaction).

- Related movements: deposit of 1,000 BTC on Hyperliquid after the swap, as highlighted on BitcoinEthereumNews.

- Note: exact BTC/ETH prices and precise transaction timestamps have not been published; on-chain verification is pending.

Timeline and On‑Chain Flows

Specialist reports tracked the sale of 4,000 BTC, followed by the purchase of approximately 96,859 ETH, with the Ether balance of the monitored address rising to an estimated position of $3.8 billion. An interesting aspect is that shortly after, the sending of an additional 1,000 BTC to Hyperliquid was reported, indicating active management between spot and derivatives.

The analyses by Cointelegraph and the summaries by BitcoinEthereumNews converge on a rotation concentrated over a short time frame, indicating a structured and planned operation. It should be noted that the final details depend on on‑chain verification.

Reasons for the Rotation from BTC to ETH

- Relative yield: expectations of potentially better ETH performance compared to BTC in the short to medium term.

- Diversification: interpreted as portfolio rebalancing, with greater exposure to smart contracts, staking, and Ethereum ecosystem activities.

- Flows from regulated instruments: increasing attention towards ETFs and derivative products linked to ETH, as discussed on Finance Magnates [data to be verified].

Operations of this scale tend to shape market perception, reinforcing accumulation narratives and shifting focus to key technical levels. In this context, the leverage component on derivatives can act as an amplifier.

How the Conversion Was Executed

Large entities reduce slippage through OTC contracts and venues with adequate liquidity depth. In the case in question, interactions with Hyperliquid and OTC channels would have plausibly mitigated the market impact, as also noted by CoinDesk.

The typical effect is short-term pressure on spot prices, followed by an adjustment of leveraged positions in the derivatives market. It should be noted that the speed of execution can impact intraday volatility.

ETH Derivatives: open interest and leverage

The metrics on open interest for ETH have remained high in recent weeks; some reports cite “spikes over $70 billion“, a value that might refer to the aggregate market and not just ETH.

An increase in open interest, combined with large spot flows, tends to increase volatility if the price approaches liquidation levels or zones with imbalances in funding.

- Open interest on ETH: can be monitored on dashboards like CoinGlass or Glassnode [data to verify];

- Whale transfers (> $1M): increasing during swap phases, as highlighted by various industry reports;

- Leverage: the risk of amplifying movements remains present during breakouts or on ambiguous signals.

Market Status of ETH and the Role of Whales

After the strong rally in August, ETH has entered a phase of consolidation. In this context, purchases on pullbacks by large addresses can help stabilize sentiment and defend support areas.

Reports indicated, at the time of analysis, ETH around $4,390, with moderate movement and volumes concentrated in narrow price ranges.

Practical Implications for Price and Sentiment

- Signal of confidence: the move suggests that long-term investors are gradually increasing their exposure to ETH.

- Professional interest: trading desks pay greater attention to basis, funding, and volatility curves, especially in the presence of rotations of this magnitude.

- Leverage effect: with high open interest, price movements can be more extensive.

Scenarios and Risks to Monitor

- Continuation of consolidation with gradual accumulation by whales and compressed volatility;

- Expansion of volatility if spot flows trigger imbalances in funding or liquidation triggers;

- Take profit on a large scale that could bring the price back to previous support levels.

Methodological Note and Points Awaiting Confirmation

- The TX ID and the addresses involved have not yet been published; an update is expected when available. For on-chain verification, it is recommended to use tools like Etherscan.

- The spot price of BTC/ETH at the time of the swap was not indicated; the estimated value of ~$435 million should be considered as an estimate based on market levels [data to be verified] (update September 1, 2025).

- The reference to an “open interest of $70 billion” might indicate the aggregate market; a detailed verification is necessary through sources like CoinGlass or Glassnode [data to be verified].

Conclusion

The rotation from BTC to ETH by a large entity shows how the movements of long-term wallets can impact the price, derivatives, and market sentiment.

As long as the open interest remains high and spot flows remain intense, the risk of wide swings – in both directions – remains high.

It is useful to monitor on-chain tools, such as Etherscan and mempool.space, to check real-time updates, keeping in mind that quantitative data can change rapidly. For technical insights on open interest and funding, see our related guide Open interest and funding: practical guide.

You May Also Like

Unlock Your Future: Volunteer at Bitcoin World Disrupt 2025 for Unrivaled Startup Networking

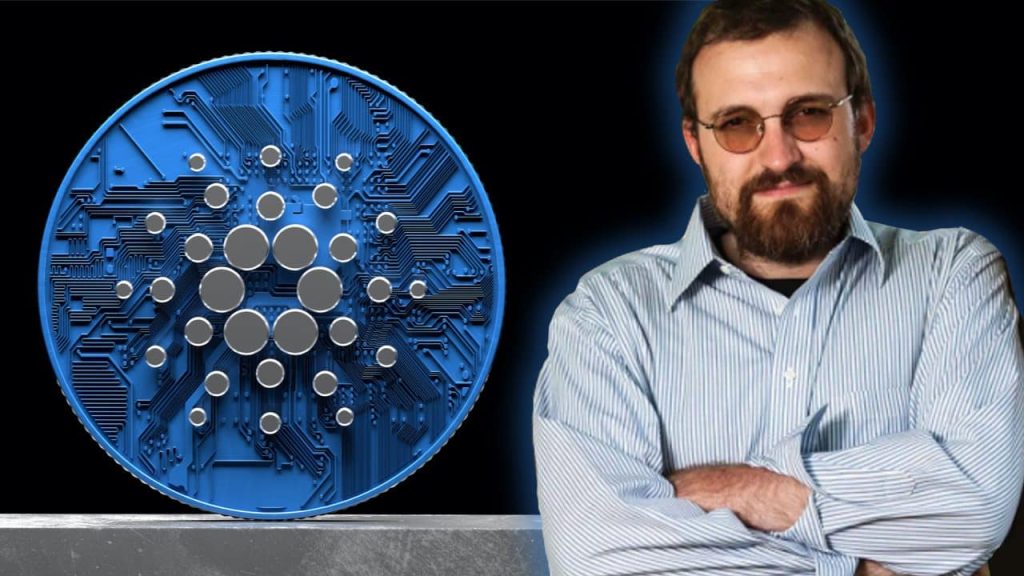

Cardano (ADA) Kurucusu Charles Hoskinson, ADA’nın Geleceği Hakkında Açıklama Yaptı!