What is Liquidity in Crypto: Ultimate Guide

Introduction

Understanding the basic concepts and major terminologies is essential for success in every area. Cryptocurrency is no different; we all know that crypto is a complex sphere to deal with and a difficult area to wander in. So, navigating there without understanding the basic concepts and terminologies would be like delving into a deep sea without a safety jacket and an oxygen cylinder. If you are a crypto enthusiast or trader, you must have heard the term ‘liquidity’. In the cryptocurrency sphere, liquidity is important

The term liquidity refers to how easily a digital asset like cryptocurrency can be bought or sold without significantly affecting its price. This article will be exclusively about the concept of ‘liquidity’, and it discusses all the important things you need to know about.

What is liquidity in crypto?

The ability to efficiently buy and sell a particular asset is always important in any kind of investment. Liquidity in the crypto market is the ease with which a digital asset, including cryptocurrency or a token, can be bought or sold without making a significant difference in its price or affecting its price. Liquidity, in simpler terms, is how quickly you can convert a crypto asset into fiat money or another crypto asset.

In a highly liquid crypto market, the trade will be easier, and on the other hand, in a market with low liquidity, investors will find difficulty in finding the potential buyers and sellers at the price they want. In simple terms, high liquidity means there will be a large volume of active traders and a stable price, whereas low liquidity involves fewer market participants and an unstable price. Prominent cryptocurrencies like Bitcoin and Ethereum are examples of highly liquid assets, and newer or less popular next-gen altcoins are examples of cryptocurrencies with low liquidity.

The major characteristics of high liquidity cryptocurrencies are easy conversion, reduced slippage, stable prices, and high trading volume. Difficulty exiting, constant price volatility, and significant slippage are some of the characteristics of low liquidity cryptocurrencies.

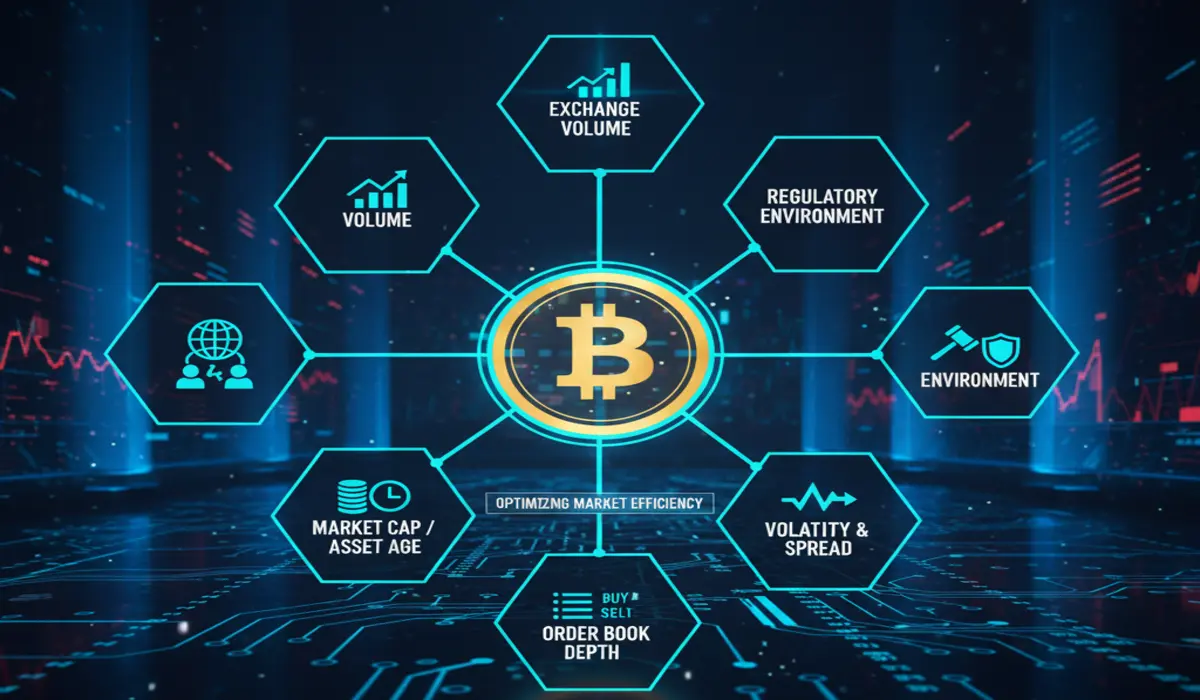

What are the Factors Influencing Crypto Liquidity?

Crypto liquidity is a concept that is influenced by various other factors, like trading volume, market sentiment, exchange activity, the regulatory environment, macroeconomic conditions, and the technological development and broader adoption of the crypto project.

Trading volume has a huge influence on crypto liquidity. Higher trading volume indicates more buyers and sellers, ultimately leading to greater ease of transaction. Market sentiment is another factor that has a powerful influence on crypto liquidity. Positive market sentiment generally increases liquidity by attracting more users, while negative sentiment can lead to low liquidity as it drives people away from the crypto project.

The regulatory environment of a particular crypto project influences the crypto liquidity by fueling investors’ confidence, market stability, accessibility and institutional participation. Macroeconomic factors or conditions influence crypto liquidity by affecting the overall market risk appetite and global capital flows, and at the same time, technological advancements of the crypto project drive crypto liquidity by improving its market efficiency, accessibility and security.

How to Check the Liquidity of a Crypto

Calculating the liquidity of a crypto project is an important process when you are in the crypto arena. To check the liquidity of a particular crypto, you can rely on various methods. Here are some techniques that you can adopt.

- Analyse Trading Volume: To check the liquidity of a crypto, you can use its 24-hour trading volume on reliable platforms like CoinMarketCap or CoinGecko. High trading volume on these platforms indicates high liquidity. Bitcoin’s daily trading volume is around $20 billion, which indicates high liquidity.

- Bid-Ask Spread: Checking the difference between the highest buy order (bid) and the lowest sell order (ask) on a crypto exchange’s order book will help you analyse the liquidity of a particular crypto. Bid-Ask spreads of less than 0.1 are generally considered high for prominent cryptocurrencies.

- Exchange Listings: You can check if the cryptocurrency is listed on multiple reputable best crypto exchanges. Crypto coins available on more platforms generally have greater accessibility and liquidity.

- Analyse Market Capitalisation : Cryptocurrencies with higher market capitalisation (Market Cap) generally attract more traders and liquidity providers, and this will lead to better liquidity. So, to identify the liquidity of a crypto using market capitalisation, check that the coin has a high market cap.

What does 100% Liquidity Mean in Crypto?

100% liquidity is a theoretical or hypothetical concept, which is practically impossible in any market, including crypto. It is not a real-world market state because there will not be any situation where traders can convert their assets to cash or another form of assets without any price change. Cryptocurrency is an extremely volatile asset that constantly undergoes changes, so any kind of ideal transfer that resembles 100% liquidity is not possible in this particular space.

It will always stay as a theoretical concept, because all markets have some friction every time. No asset, whether a traditional stock or crypto, operates with 100% liquidity, because in any trade, there will be a marginal supply or demand change.

Liquidity vs Market Cap in Crypto

Liquidity and market cap are two closely related but different concepts in the crypto space. These two market components are important and play a major role in the way we understand and execute crypto trades. The major difference between these two concepts is that market cap focuses on the value of a particular token, whereas liquidity focuses on the ease of trading it.

Market cap is the total value of all circulating coins or tokens. This value is calculated by multiplying the current price of one token by the total number of coins in circulation.

Market Cap = Current Price Per Coin × Circulating Supply of Coins

Liquidity in crypto is the ease of a digital asset transaction (Selling or buying) without significantly affecting its price.

Here are the key differences between liquidity and market cap.

| Market Cap | Liquidity |

| Focuses on the token’s value | Focuses on the ease of trading it |

| It is calculated based on the share price and token circulation. | Liquidity is measured by factors like trading volume and the bid-ask spread. |

| It is used to compare the overall size of two different crypto projects | It is used to assess the risk of trading an asset and the potential for large price movements from trades. |

The Bottom Line

To master a particular area, you need to comprehensively understand the entire concept in that space. Liquidity in crypto is something that all crypto traders and enthusiasts should be aware of. Liquidity is a factor when you are initiating a particular transaction using crypto. The prominent assets like Bitcoin and Ethereum will have higher liquidity, whereas new projects and less famous projects have comparatively lower liquidity, so always choose crypto with higher liquidity when you are into it. This article covered all the important facts related to liquidity in crypto. understand the market components before diving deeply into it.

Disclaimer: The information provided here is for informational and educational purposes only and should not be considered financial, investment, legal, or tax advice. We are not financial advisors, and you should consult a qualified financial professional before making any investment decisions

The post What is Liquidity in Crypto: Ultimate Guide appeared first on BiteMyCoin.

You May Also Like

Mid-tier Bitcoin miners gain ground, reshaping post-halving competition

Smaller Bitcoin miners surge in hashrate and debt as competition intensifies post-halving, reshaping the industry’s balance of power. The Bitcoin mining industry is becoming increasingly competitive, with so-called tier-2 operators closing the gap on established leaders in realized hashrate — a sign of a more level playing field following the 2024 halving.According to The Miner Mag, companies such as Cipher Mining, Bitdeer and HIVE Digital have rapidly expanded their realized hashrate after several years of infrastructure growth, narrowing the distance to top players like MARA Holdings, CleanSpark and Cango.“Their ascent highlights how the middle tier of public miners — once trailing far behind — has rapidly scaled production since the 2024 halving,” The Miner Mag wrote in its latest Miner Weekly newsletter. Read more

Wormhole launches reserve tying protocol revenue to token