Why Are Bitcoin and Ethereum Suddenly Dropping Today? Experts Reveal Shocking Reasons

The people closely associated with the crypto sector know that the total crypto market is experiencing a significant downturn, leading to the price drop of prominent cryptocurrencies like Bitcoin, Ethereum, XRP, etc. The market experts opine that the latest trend is due to the combination of multiple factors, like the recent Federal Reserve rate cut, increased macroeconomic uncertainty, significant liquidations from leveraged trading, and substantial outflows from Bitcoin ETFs.

Bitcoin and Ethereum are two pillars of the entire crypto market, but these tokens have been experiencing an unprecedented dip these days. According to various market analyses, the sudden and ongoing price drop of Bitcoin and Ethereum prices is fueled by large-scale liquidations, broader macroeconomic anxieties, and the cautious environment following the Federal Reserve actions implemented by the authorities.

Why are Bitcoin and Ethereum Suddenly Dropping Today?

The entire crypto market is seeing a significant pullback, and so are Bitcoin and Ethereum, two of the most in-demand cryptocurrencies in the world. Bitcoin, the most valuable cryptocurrency in the world, currently trades at $109,617.70, 1.9% lower than the previous day’s price. The token is trading with a 24-hour trading volume of $ 93.46 billion, a market capitalization of $ 2.18 trillion, and a market dominance of 58.19%.

Ethereum, the second-largest cryptocurrency by market cap after Bitcoin, is trading below the $4,000 price point. According to the latest analytics, ETH is valued at around $ 3,939.42 with a 24-hour trading volume of $ 97.70 billion, a market cap of $ 475.50 billion, and a market dominance of 12.66% and its price reportedly decreased by -1.84% in the last 24 hours.

Bitcoin has been significantly volatile during the ongoing “Red September” narrative; the token has been floating between $108,780 and $113,700, indicating that even the strongest cryptocurrencies are subject to and sensitive to macroeconomic factors.

Experts from the crypto arena stated that Bitcoin had dipped alongside traditional markets after Fed Chair Powell had warned of labor market risks and stubborn inflation on September 24, despite the first 2025 rate cut. They noted that traders had priced in a 91.9% chance of an October rate hike, but crypto had seen $1.7B in liquidations, the highest since December 2024.

Ethereum is down today due to a lot of combined factors, and on top of that, the fear of a potential U.S. government shutdown remains. This factor incited a general sell-off trend in the digital asset sector, fueling ETH’s price drop.

The Washington Post reported on Friday that the White House was preparing federal agencies for widespread layoffs if the government shut down the following week, leaving new uncertainty about what would close and what would stay open if funding ran out on October 1. The fears of this shutdown triggered investor anxiety and caused the token to fall below the $4,000 psychological level.

Bitcoin and Ethereum Spot ETFs Experienced Outflows!

As per expert analysis, the Bitcoin and Etherem spot ETFs have experienced significant outflows. The latest market data suggest that BTC Spot ETFs experienced a net outflow of $258.46 million on September 25. Fidelity’s FBTC ETF experienced $114.8 million in withdrawals; however, on September 24, Bitcoin ETFs managed to display a $241 million net inflow.

Ethereum Spot ETFs suffered their fourth consecutive day of outflows on September 25. Based on the data-driven analysis, ETH spot ETFs suffered a total outflow of $251.2 million. Fidelity’s FETH experienced a $158.07 million outflow, whereas Grayscale’s ETHE suffered a $30.27 million outflow.

Yahoo Finance reported that as of September 23, Bitcoin spot ETFs held $147.2 billion in net assets, representing 6.6% of the cryptocurrency’s total market capitalization. They stated that cumulative inflows stood at $57.25 billion. It was also reported that Ethereum spot ETFs now held $27.5 billion in net assets, representing 5.45% of the total ETH market, with cumulative inflows reaching $13.7 billion.

Bitcoin and Ethereum Price Drop: Expert Insights

Experts believe that there are plenty of reasons for this current ETH and BTC price drop, and some common factors in the crypto sphere, like regulatory uncertainties, are further pushing digital tokens downward. Analysts at CoinSwitch Markets Desk stated that heavy outflows from Ether-based ETFs showed that institutional investors were turning cautious.

Some Bloomberg analysts stated that one of the biggest reasons for that day’s slump was the rising fear of a U.S. government shutdown. Ted Pillows, one of the leading crypto analysts, claims that the drop was a textbook shakeout—big, leveraged bets unwinding and institutional sentiment going sideways until they got regulatory clarity.

The post Why Are Bitcoin and Ethereum Suddenly Dropping Today? Experts Reveal Shocking Reasons appeared first on BiteMyCoin.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

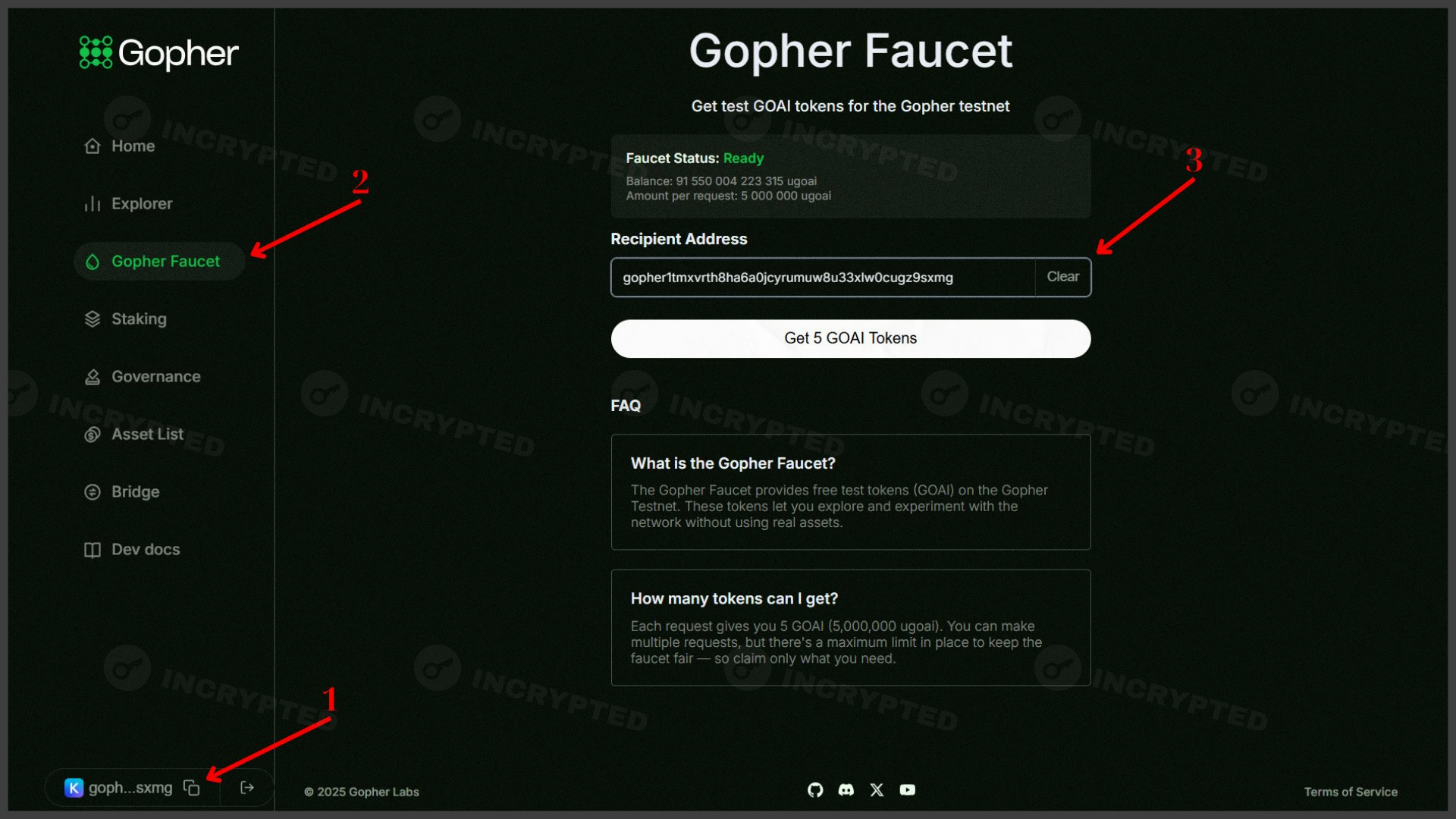

Gopher — active participation in the testnet with the aim of airdrop