Wall Street is going bullish on Baidu, Nvidia’s top chip competitor in China

Baidu is finally getting the kind of attention it’s been quietly waiting for, and Wall Street is suddenly piling in.

Analysts at Goldman Sachs and Macquarie Securities both told the trading floor this week that Kunlunxin, Baidu’s chip unit, will unlock serious value if it goes public, advising investors to start considering it.

Hong Kong-listed shares of Baidu have now had their average price target boosted by around 60% since late August, which was just a little over 3 months ago, and the third-largest rally across the Hang Seng Tech Index entire history.

China’s state regulator has approved the public listing of Kunlunxin in Hong Kong, meaning an AI chip unit ran by the CCP is going to have its own stock by this time next year.

It’s all so serious.

Baidu’s chip unit pulls in big orders and bigger bets

Since China Mobile, a state-owned telecom giant, handed Kunlunxin its first big chip order, Baidu’s stock has surged 45%, and that was before the IPO talk even started.

Ellie Jiang, an analyst at Macquarie, said Kunlunxin is now worth around $16.5 billion based on Baidu’s 59% ownership, which is about 30% of her total valuation for the company.

Ellie is predicting that Kunlunxin’s revenue will double to $1.4 billion next year, putting it neck and neck with Cambricon Technologies, the domestic chipmaker that global retail investors love to call “China’s Nvidia.”

But hey, Cambricon is dealing with capacity bottlenecks, and Huawei is still dealing with foreign tech restrictions, so they’re not really ready to face Nvidia right now. Kunlunxin, on the other hand, already has a real customer base and is deeply integrated across Baidu’s cloud platform, powering its AI models, infrastructure, and applications.

Goldman Sachs argued that Baidu’s edge is growing as demand shifts toward inference chips. “Baidu Cloud can offer alternative options for AI models inference and even training tasks, at competitive pricing,” said the bank in a research note Thursday. “As chip demand moves towards inference usage over time, Baidu’s Kunlun could be a good fit for users given its high inference efficiency.”

Nvidia hits a wall as China boosts local players

While Donald Trump just approved restricted access to Nvidia’s H200 chips for China after nearly a year of delays, that green light didn’t go very far. Xi Jinping immediately responded that he would still limit imports of Nvidia’s chips.

His priority, he said, was pushing domestic firms like Kunlunxin instead. It wasn’t expected, but also kind of was. This is the AI Wars after all, and as much as Trump likes to say it, Jinping isn’t actually his friend. For China, the priority remains global tech dominance. They’ve been saying that for at least a decade now.

ANyway, this leaves Nvidia more exposed, because as Jensen Huang has said time and time again, his company still needs the Chinese market. Without it, all of the company’s plans kind of come to a bit of a halt.

We can prove it too. In Q3, Nvidia’s accounts receivable (money customers owe) jumped $16 billion to $33 billion. But accounts payable, the money Nvidia owes, only climbed $3 billion to $8 billion. That massive gap now has to be funded while Nvidia waits to get paid.

And oh boy, things aren’t going smoothly in the markets either. Invesco’s SPHQ ETF, which dumped Nvidia in June, had been beating iShares’ QUAL fund all year… until now.

Over the past six months, SPHQ has underperformed by the biggest margin since 2013, except for QUAL’s launch period.

Even among so-called “quality” stocks, Nvidia’s current financial setup is triggering volatility that’s throwing off traditional fund strategies.

Meanwhile, institutional investors are loading up on Chinese tech. Vanguard, BlackRock, and Fidelity have all been quietly increasing their holdings in Alibaba’s Hong Kong shares.

That’s not all.

Tencent and Baidu, both building out large-language models for generative AI, have seen their stocks rise by nearly 50%.

The trend isn’t slowing. Amundi, BNP Paribas, Fidelity International, and Man Group all expect Chinese equities to keep climbing into 2026. JPMorgan Chase just raised its rating on the market to overweight.

And Gary Tan, a fund manager at Allspring Global Investments, called the asset class “indispensable” for foreign money managers now chasing growth outside the US.

Get up to $30,050 in trading rewards when you join Bybit today

Ayrıca Şunları da Beğenebilirsiniz

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

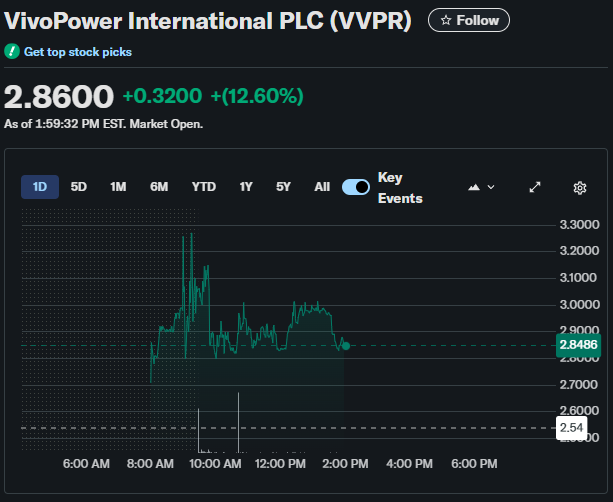

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally