Brazil’s Biggest Private Bank Says 3% Bitcoin Can Boost Portfolio Diversification

- Itaú Asset suggests a small Bitcoin allocation to help offset local currency depreciation risks.

- They view Bitcoin as a complementary asset that adds unlinked returns to traditional portfolios.

Brazil’s largest private bank, Itaú Unibanco, is advising investors to set aside between 1% and 3% of their portfolios for Bitcoin in the coming year. The guidance comes from Itaú Asset Management, its investment branch, which has highlighted growing global risks as a reason to consider the asset. The bank stated,

Renato Eid, a representative from Itaú Asset, described Bitcoin as separate from conventional investments such as fixed income, equities, and domestic assets. He pointed to its global and decentralized nature, which adds a unique layer of value as a potential currency hedge.

The bank made clear that it does not advocate placing crypto at the center of a portfolio. Instead, Bitcoin should act as a supporting piece that helps balance other investments, particularly when traditional assets fall short in offsetting geopolitical or monetary shifts. Eid said,

Bitcoin’s Role as a Buffer in Brazilian Portfolios

Brazilian investors have faced deeper Bitcoin swings this year than others, largely due to the 15% appreciation of the Brazilian real. Bitcoin’s price fluctuation has intensified exposure at the local level, making volatility in Brazil more noticeable compared to other markets.

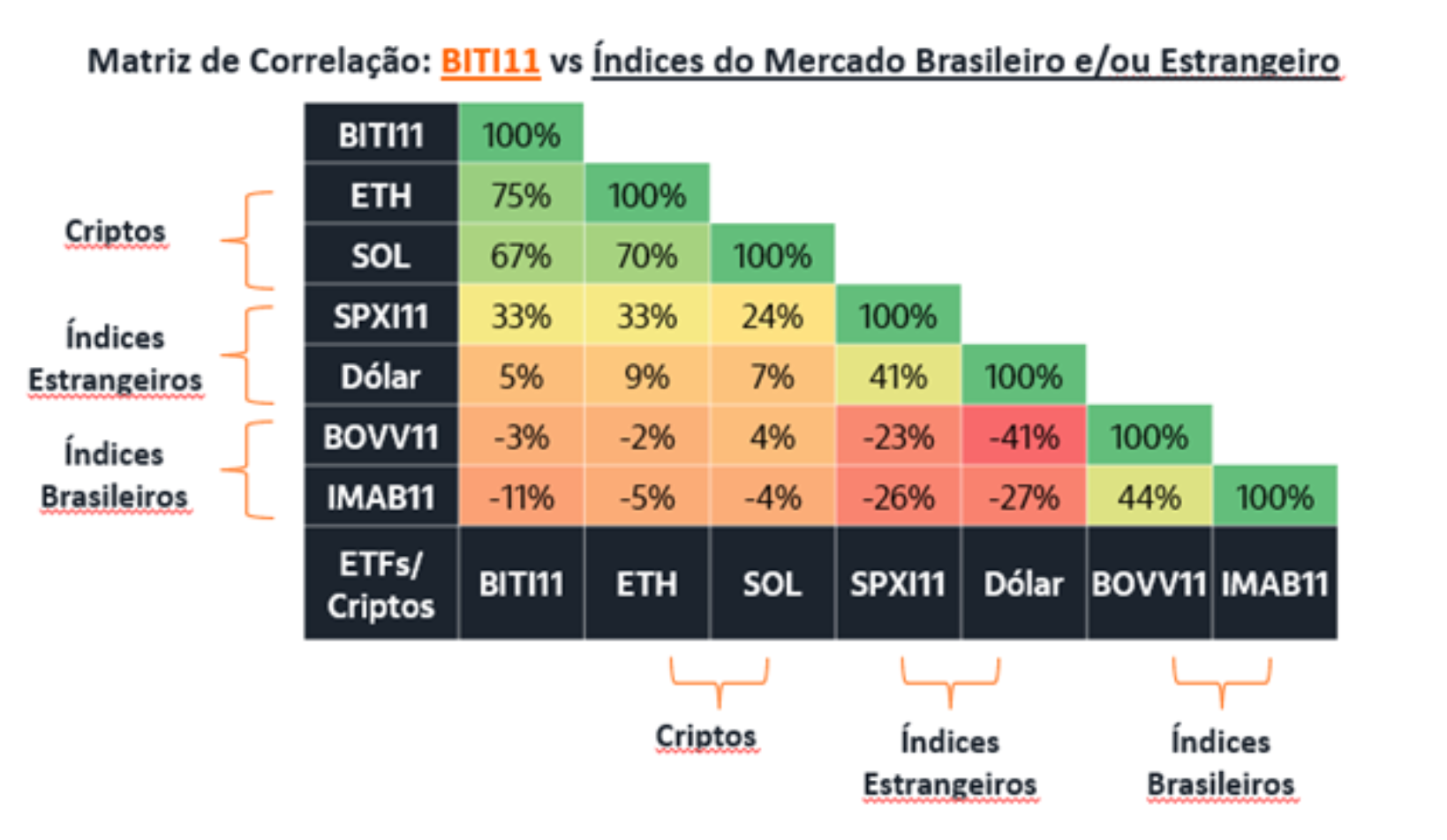

Despite that, Itaú Asset maintains that Bitcoin offers useful characteristics for managing investment risk. The bank pointed to its data showing low correlation between traditional investments and BITI11, a Bitcoin ETF listed in Brazil. The bank added,

A correlation matrix showing BITI11 alongside major Brazilian and global market indices. Source: Itaú

A correlation matrix showing BITI11 alongside major Brazilian and global market indices. Source: Itaú

Institutional Support for Crypto Allocation Grows

The recommendation from Itaú comes at a time when major financial institutions globally are making space for digital assets in client portfolios. Morgan Stanley’s investment committee has suggested that qualified clients could hold 2% to 4% in crypto assets.

Bank of America has proposed an allocation of 1% to 4%, with plans to begin tracking Bitcoin ETFs from Bitwise, Fidelity, Grayscale, and BlackRock early next year. This move would enable its 15,000 advisers to discuss those funds with clients.

In September, Itaú Asset launched a dedicated crypto unit and placed João Marco Braga da Cunha, previously with Hashdex, at the helm. The division builds on earlier products such as the Bitcoin ETF and a retirement plan with crypto exposure.

Itaú is also planning to develop a wider set of offerings that could include fixed-income-type investments as well as higher-risk tools like derivatives and staking. The bank’s aim is to meet the rising interest among investors while keeping product design within regulated boundaries.

]]>Ayrıca Şunları da Beğenebilirsiniz

CME Unleashing XRP Options After $16B Futures Rally Signals Strong Institutional Demand

What Devs Are Actually Doing