Shiba Inu May Run 25x Again, Yet Ozak AI’s 2026 Outlook Looks Far More Explosive

Crypto market excitement continues rising as Shiba Inu shows one of the cleanest accumulation structures among major meme assets, with analysts projecting the possibility of another 20x–25x surge during the upcoming bull cycle. SHIB’s strong community energy, expanding ecosystem, and recurring viral momentum place it firmly on the list of high-upside meme tokens for 2025.

Yet while SHIB’s potential remains impressive, the project generating far more analyst attention—and far more explosive long-term forecasts — is Ozak AI (OZ), the real-time AI intelligence engine already operating with millisecond predictive models, autonomous multi-chain agents, and cross-chain analytics. Its 2026 outlook suggests a growth curve far steeper than SHIB’s, positioning Ozak AI as one of the strongest exponential ROI opportunities of the next cycle.

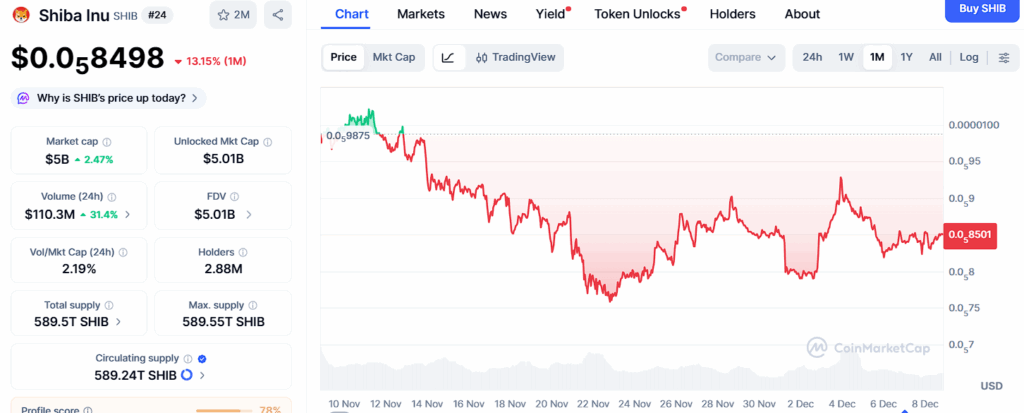

Shiba Inu (SHIB)

Shiba Inu trades near $0.000008498 and continues forming a strong multi-layer support base that historically precedes sharp meme-driven expansions. Support at $0.000008320 stabilizes immediate price action, while deeper foundations at $0.000008120 and $0.000007900 reinforce the long-term macro trend.

SHIB begins generating bullish continuation pressure as it approaches resistance at $0.000008740, followed by higher challenge zones at $0.000008960 and $0.000009240 — classic breakout regions that have triggered explosive upside during previous cycles.

This setup supports the possibility of another major SHIB rally, but analysts highlight that meme coins ultimately rely on social sentiment, not functional utility. Ozak AI represents the opposite model: value generated through intelligence, real-time performance, and evolving cross-chain capability.

Ozak AI (OZ)

Ozak AI’s rapid rise in analyst forecasts is driven by one defining advantage — its technology is already active before launch. Its intelligence engine analyzes blockchain conditions in milliseconds, interpreting liquidity shifts, volatility patterns, and market activity with precision. HIVE’s 30 ms execution-grade signals feed high-resolution predictive data directly into the core system, while SINT-powered autonomous agents scan multiple chains and adjust strategies instantly.

Perceptron Network’s 700K+ node architecture strengthens this even further, giving Ozak AI true multi-chain visibility and constant data inflow. As more data passes through the system, Ozak AI becomes smarter, faster, and more accurate—a self-improving intelligence cycle that compounds its long-term valuation potential. This intelligence-driven evolution is why analysts position Ozak AI for a 50x–100x trajectory by 2026, far surpassing even the strongest SHIB projections.

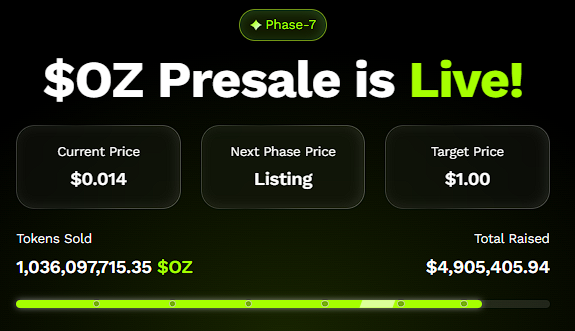

Ozak AI Presale

The Ozak AI Presale surpassing $4.9 million signals a rare level of early conviction among both retail investors and strategic buyers. Unlike typical presales that depend on future development, Ozak AI enters the market with real, functioning infrastructure. This dramatically lowers early-stage risk and increases long-term adoption potential.

Investors who successfully captured early exponential gains in previous cycles—from LINK to MATIC to SOL — are now rotating early into Ozak AI, citing its intelligence-first architecture and low entry valuation as catalysts for massive future returns. SHIB remains a strong meme asset, but Ozak AI is increasingly viewed as a technological cornerstone for the emerging AI-crypto convergence.

Ozak AI Leads the 2026 Explosive Forecast

Shiba Inu may still deliver a major 25x rally, and history suggests SHIB is capable of spectacular cycle peaks. Its structure supports this, and its community remains one of the most powerful forces in crypto.

But Ozak AI operates on a completely different trajectory — one shaped by real-time intelligence, cross-chain predictive capability, autonomous AI agents, and compounding learning models that improve continuously. SHIB grows through hype. Ozak AI grows through intelligence.

This distinction is why analysts overwhelmingly favor Ozak AI for the strongest explosive potential heading into 2026. As the market prepares for the next wave of AI-driven expansion, Ozak AI is emerging as the project most likely to generate life-changing returns — far outpacing even a powerful SHIB rally.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

Ayrıca Şunları da Beğenebilirsiniz

Wholecoiner Inflows to Binance Hit Cycle Lows, Signaling Reduced Sell Pressure

Coinbase Vs. State Regulators: Crypto Exchange Fights Legal Fragmentation