Bitcoin And The Quantum Panic: What Developers Are Actually Doing

Quantum risk has become a recurring stress point in Bitcoin discourse, often framed as an existential threat. The claim usually follows a familiar arc: quantum computing is advancing quickly, cryptography is vulnerable, and Bitcoin isn’t adapting fast enough.

Marty Bent doesn’t buy that framing. In his Dec. 14 episode, Bent acknowledged that quantum computing represents a genuine risk — not just for Bitcoin, but for any system built on modern cryptography — while pushing back on the idea that Bitcoin developers are ignoring the issue.

“Short answer is yes, it is a risk,” Bent said. “But it’s not only a risk for Bitcoin. It’s a risk for any system that depends on cryptography for security.”

What Developers Are Doing To Make Bitcoin Quantum-Safe

What tends to get lost, he argued, is the work already underway. Bent pointed to ongoing developer discussions and, more recently, a research paper published by Blockstream’s Jonas Nick and Mikhail Kutunov examining hash-based, post-quantum signature schemes tailored specifically for Bitcoin.

“I just wanted to make this video to push back on that notion,” Bent said, referring to claims that Bitcoin isn’t moving fast enough. “Because I think it’s pretty clear if you’ve been following Bitcoin development discussions over the last year, the quantum risk is certainly being taken seriously and the conversations have started.”

Nick summarized the paper in a Dec. 9 post on X, describing it as an analysis of post-quantum schemes optimized for Bitcoin’s constraints rather than generic cryptographic benchmarks. Bent described the work as a signal that research is shifting from abstract concern to concrete design space.

Nick wrote via X: “Hash-based signatures are conceptually simple and rely solely on hash functions, which is a primitive Bitcoin already trusts. While NIST has standardized SLH-DSA (SPHINCS+), we investigate alternatives that are better suited to Bitcoin’s specific needs. We explore in detail how various optimizations and parameter choices affect size and performance. Signature size can be reduced to ~3-4KB, which is comparable to lattice-based signature schemes (ML-DSA).”

The challenge, Bent emphasized, isn’t a lack of candidate solutions. It’s that Bitcoin is a globally distributed system with nearly 17 years of operational history, and changes at the protocol level come with heavy trade-offs. “Bitcoin is a globally distributed peer-to-peer system that depends on consensus protocol rules that are very hard to change,” Bent said. “And you really don’t want to change them too often.”

That reality complicates any transition to quantum-resistant signatures. Existing address types, HD wallets, multisig setups, and threshold schemes all need to be considered. And beyond compatibility, there’s the question of performance.

“One of the biggest hurdles when approaching this problem in Bitcoin is that many quantum-resistant schemes are very data intensive,” Bent said. “Yes, there are many different schemes that can be implemented. However, they come with trade-offs — particularly verification and bandwidth trade-offs.”

Larger signatures can slow block propagation and make it more expensive to run a full node, which directly impacts decentralization. The Blockstream paper focuses heavily on that tension, exploring optimizations that could reduce signature sizes to a few kilobytes while keeping verification costs manageable.

“They feel pretty confident that they’ve done the research to find signature schemes that would have a nice trade-off balance,” Bent said. “You get quantum resistance, but at the same time it remains conducive for people to download full nodes and verify transactions without needing a significant amount of bandwidth and data storage.”

Bent was careful not to frame the research as a finished solution. Instead, he described it as groundwork — mapping the problem space early so the network isn’t caught flat-footed if quantum capabilities advance faster than expected.

“This is by no means like, ‘hey, we solved the problem,’” he said. “But we are taking this problem seriously, doing research and beginning to figure out ways in which we could solve the quantum risk that may or may not manifest in the medium to long term.”

He also noted that BTC tends to be singled out in quantum discussions, even though most of the internet relies on cryptographic assumptions that would face similar pressure in a true post-quantum scenario.

“If quantum computers do come, Bitcoin is not the only thing,” Bent said. “Almost everything you touch on the internet is depending on some cryptographic security at some point.”

For now, Bent’s takeaway was measured. Quantum risk exists. Progress in quantum computing is real. But the narrative that developers are ignoring the issue doesn’t align with what’s happening in technical circles.

“Very smart developers, cryptographers more importantly, are researching the problem,” he said. “If you know where to look, it’s pretty clear that people are preparing for this.” Not solved. Not ignored. Just quietly being worked on.

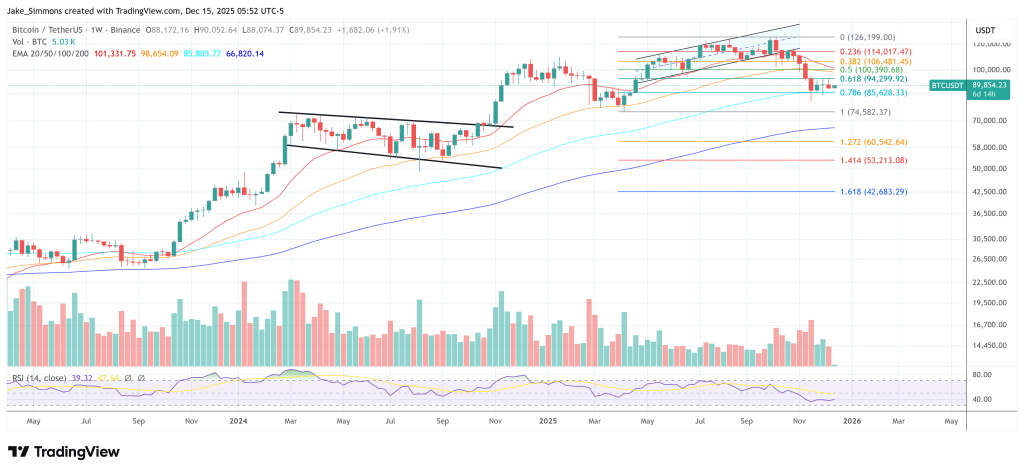

At press time, BTC traded at $89,854.

Ayrıca Şunları da Beğenebilirsiniz

The Best Crypto To Buy Now Isn’t Solana As Viral Layer Brett Takes Centre Stage After Being Tipped As #1

TRON DAO Senior Director of Policy Addresses Policy Frameworks Bridging TradFi and DeFi at Abu Dhabi Finance Week