Gemini Launches Prediction Markets Across All 50 US States After Five-Year Wait

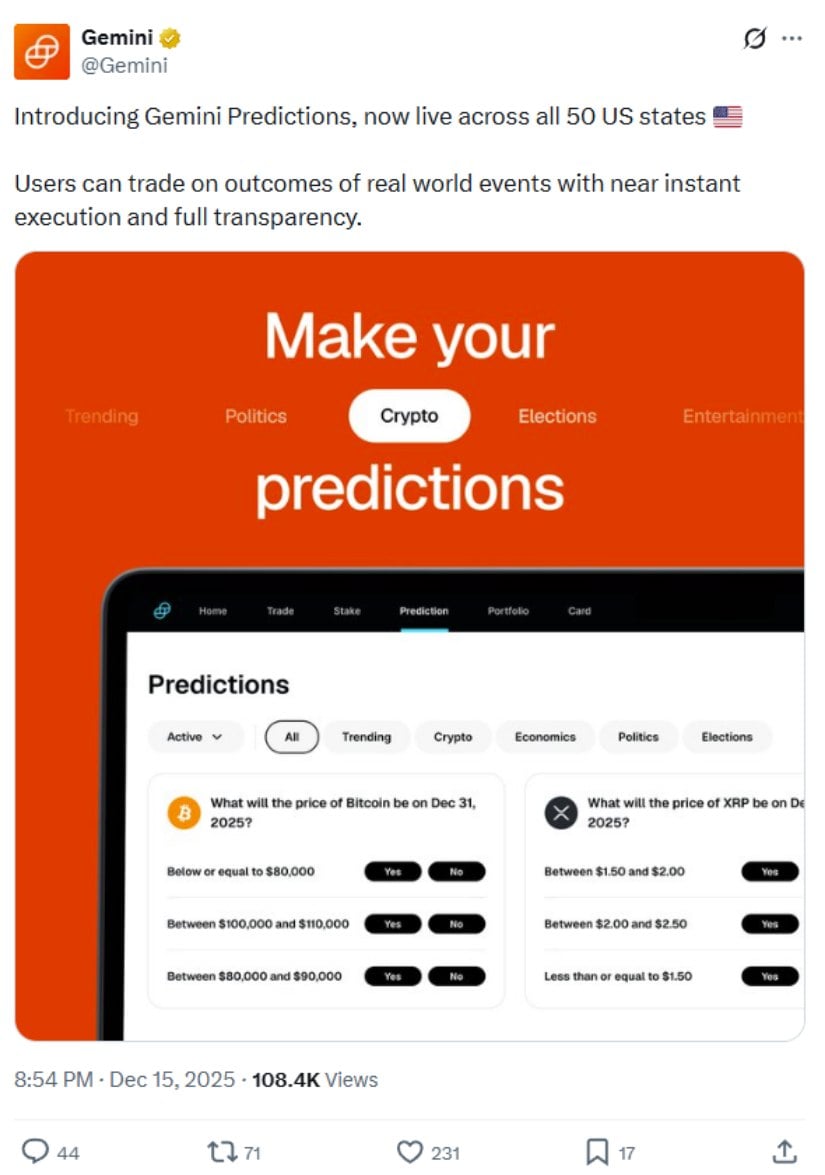

The platform, called Gemini Predictions, allows users to bet on real-world outcomes through simple yes-or-no contracts.

The launch follows a five-year licensing process that began when Gemini first applied for approval in March 2020. The Commodity Futures Trading Commission granted Gemini’s affiliate, Gemini Titan LLC, a Designated Contract Market license on December 10, clearing the way for regulated prediction markets.

How Gemini Predictions Works

Gemini Predictions lets users trade on future events using US dollars already in their Gemini accounts. The platform offers binary contracts where traders pick “yes” or “no” on specific outcomes. For example, users can bet whether Bitcoin will close the year above $200,000 or whether Elon Musk’s X will pay a $140 million fine to the European Commission by 2026.

The exchange promises near-instant execution and full transparency on all trades. Users can access the platform through Gemini’s website and iOS app, with Android support coming soon. To attract early users, Gemini is waiving trading fees for a limited time.

Source: @Gemini

Gemini CEO Tyler Winklevoss credited President Trump and Acting CFTC Chair Caroline Pham for the approval. “It’s incredibly refreshing and invigorating to have a President and a financial regulator who are pro crypto, pro innovation, and pro America,” Winklevoss said in a statement.

Entering a Booming Market

Gemini joins a rapidly growing sector that exploded during the 2024 US election. Kalshi and Polymarket, the two leading platforms, processed roughly $9.5 billion in combined trading volume in November alone.

The prediction markets industry could reach $95 billion by 2035, growing at 46% annually. Venture capital firms have invested $2.67 billion into the sector this year. Kalshi raised $1 billion at an $11 billion valuation in early December 2025, while Polymarket secured $2 billion from Intercontinental Exchange at an $8 billion valuation.

Gemini President Cameron Winklevoss believes prediction markets could rival traditional capital markets in size. “Acting Chairman Pham understands this vision and its importance,” he said, contrasting the current regulatory approach with the previous administration’s stance.

The platform represents another step in Gemini’s strategy to become a “one-stop financial super app.” Beyond cryptocurrency trading, the exchange offers staking services, tokenized stocks, and crypto credit card rewards. Gemini Titan plans to explore additional derivatives products for US customers, including crypto futures, options, and perpetual contracts.

Stock Falls Despite Launch

Despite the nationwide rollout, Gemini’s stock dropped 12.14% to $11.61 during regular trading hours on Monday. Shares fell another 5.38% in after-hours trading to $10.99.

The stock had previously surged 13.7% when the CFTC approval was announced on December 11. However, Gemini Space Station Inc. remains down over 60% from its peak since going public on Nasdaq in September 2025.

Regulatory Challenges Ahead

While Gemini secured federal approval, prediction market operators face mounting pressure from state regulators. Connecticut’s Department of Consumer Protection issued cease-and-desist orders to Kalshi, Robinhood, and Crypto.com on December 2, accusing them of offering unlicensed sports betting.

A federal judge granted Kalshi temporary relief from Connecticut’s enforcement action on December 9. The judge ordered state regulators to pause enforcement while the court reviews the case, with oral arguments scheduled for mid-February.

At least nine other states have challenged prediction market operators this year, including Arizona, Illinois, Montana, Nevada, New Jersey, Maryland, Ohio, New York, and Massachusetts. State gambling authorities argue that event contracts function like sports bets and should fall under state gambling laws.

Kalshi maintains that its markets are federally regulated derivatives products under exclusive CFTC jurisdiction. The company has filed lawsuits against regulators in multiple states, arguing that state gambling laws don’t apply to CFTC-regulated markets.

The legal battles highlight tensions between federal commodities regulation and state gambling authority. How courts resolve these disputes will shape whether prediction markets become widely accessible or remain limited by state-by-state restrictions.

Competition Heats Up

Gemini enters a market currently dominated by two major players. Polymarket, which operates offshore using blockchain technology, recently resumed US operations after being banned in 2022. The platform began rolling out access to over 200,000 waitlisted US users in early December.

Kalshi holds the distinction of being the first CFTC-regulated prediction market platform and recorded $4.54 billion in trading volume in November. The company recently partnered with CNN to provide real-time market data for the network’s coverage of political and economic events.

Coinbase, the largest US crypto exchange, is reportedly preparing to launch its own prediction markets platform around December 17. Other companies entering the space include Crypto.com, which powers prediction platforms for Trump Media’s Truth Social and sports retailer Fanatics.

Robinhood has driven significant volume to Kalshi through a distribution partnership, at times accounting for more than 50% of Kalshi’s trading activity. The growing competition suggests mainstream finance sees prediction markets as a major opportunity.

Beyond the Hype

Gemini’s entry transforms the prediction markets landscape from a duopoly into a three-way competition among major regulated players. The exchange brings an established user base of approximately 523,000 monthly transacting users and regulatory licenses in all 50 states..

The broader question remains whether prediction markets will evolve into mainstream financial tools or face continued restrictions. Federal approval provides legitimacy, but state-level opposition could limit growth and fragment the market by geography.

For now, Gemini offers US users another regulated option to trade on future events. Whether prediction markets become as transformative as the Winklevoss twins predict depends on resolving the fundamental legal question: are these contracts derivatives or gambling?

Ayrıca Şunları da Beğenebilirsiniz

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move