Bitcoin Plunges Below $115K Amid Trump Nuclear Threats and Fed Shake-Up

Bitcoin plunged below $115,000 on Friday as renewed political pressure from former President Donald Trump unsettled markets.

The top cryptocurrency dropped to $113,164, its lowest in weeks, triggering over $200 million in liquidations from leveraged long positions and raising fresh concerns over investor confidence. The drop comes amid escalating geopolitical tension.

Trump Orders Submarine Move Amid Russia Tensions, Bitcoin Reacts to Risk Fears

Trump announced the repositioning of two U.S. nuclear submarines in response to comments by former Russian President Dmitry Medvedev, now deputy chairman of Russia’s Security Council. Medvedev had criticized Trump’s ultimatum that Russia end its conflict with Ukraine within ten days, calling it “a step towards war.”

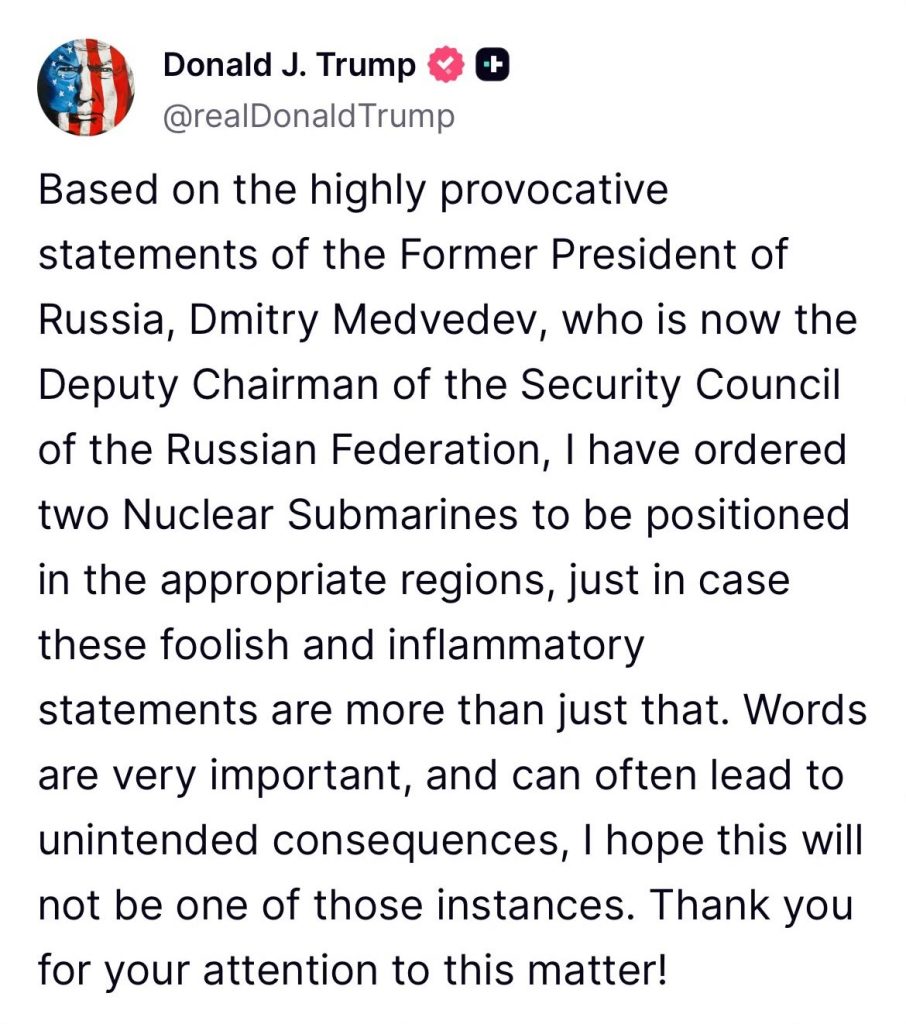

“Based on the highly provocative statements of the former president of Russia, Dmitry Medvedev, […] I have ordered two nuclear submarines to be positioned in the appropriate regions,” Trump wrote on Truth Social.

He added that “Words are very important and can often lead to unintended consequences. I hope this will not be one of those instances.”

Bitcoin’s price decline followed these remarks from Trump, reflecting broader investor anxiety as tensions between nuclear powers rise.

Friday’s market reaction also follows Trump’s public attacks on U.S. economic institutions. The former president accused Erika McEntarfer, Commissioner of Labor Statistics, of manipulating jobs data ahead of the 2024 election to help Kamala Harris.

He called for her immediate removal and claimed the Bureau had “faked the jobs numbers” by overstating employment growth.

“We need accurate Jobs Numbers,” Trump wrote. “She will be replaced with someone much more competent and qualified.”

He also turned his attention to the Federal Reserve, sharply criticizing its chair, Jerome Powell. Trump claimed the Fed’s pre-election rate cuts were politically motivated and called Powell “a stubborn MORON.”

“Jerome ‘Too Late’ Powell must substantially lower interest rates NOW,” he wrote. “IF HE CONTINUES TO REFUSE, THE BOARD SHOULD ASSUME CONTROL AND DO WHAT EVERYONE KNOWS HAS TO BE DONE!”

While presidents traditionally avoid interfering with central bank decisions, Trump urged Fed officials to overrule Powell and slash rates to support what he described as a booming economy under his leadership.

The Fed has held rates steady for five consecutive meetings, citing inflation concerns. But Trump, in a flurry of posts, accused Powell of damaging the economy and failing to act on the consequences of new tariffs.

Fed Governor Adriana Kugler Resigns, Opening Key Seat for Trump

Amid the political pressure, Federal Reserve Governor Adriana Kugler announced her resignation on Friday, creating a key vacancy at the central bank. Kugler, a Biden appointee, joined the Fed’s Board of Governors in 2023 and was a permanent voting member on the Federal Open Market Committee.

She did not give a reason for her early departure but stated she would return to Georgetown University in the fall.

“It has been an honor of a lifetime to serve,” Kugler wrote in a letter addressed to Trump. Her exit, nearly 18 months before her term was set to expire, clears a path for Trump to nominate a replacement.

Kugler had recently voiced support for keeping rates steady, pending a clearer picture of how tariffs are affecting inflation. She was absent during this week’s policy vote, where two Trump-appointed members dissented, favoring a rate cut.

Fed Chair Jerome Powell thanked Kugler for her service, noting her contributions brought “impressive experience and academic insights” to the Board.

Bitcoin Slides as Political Tensions and Market Jitters Weigh on Sentiment

Bitcoin slipped further on Friday as rising geopolitical tensions and cautious investor sentiment added pressure to already fragile markets. The cryptocurrency is now trading just 7% below its all-time high of $123,182 set in mid-July, though momentum in derivatives markets is showing signs of cooling.

Notably, the monthly futures premium for Bitcoin has narrowed to 6%, down from earlier highs this month. Analysts say the drop reflects reduced appetite for leveraged long positions, suggesting traders are becoming more risk-averse despite ongoing institutional interest.

Bitcoin’s recent price behavior has also contributed to uncertainty. Rather than acting as a hedge, the asset has moved in step with tech stocks, exposing it to broader macro and political shocks. With tensions between the U.S. and Russia flaring again this week, risk appetite appears to be shifting.

The political back-and-forth added to a market already grappling with trade friction and weak economic data. While gold has remained stable around $3,350, it has offered little relief for those hoping Bitcoin would act as a safe-haven alternative. Traders appear to be rotating into cash and short-term government bonds as volatility increases.

Despite the decline, Bitcoin remains well above its January levels. However, with global uncertainty rising, traders may remain cautious in the short term.

Amid the broader pullback, some investors are reassessing Bitcoin’s long-term role. Bridgewater Associates founder Ray Dalio, previously skeptical, has updated his outlook. Speaking on a recent podcast, Dalio recommended allocating up to 15% of a portfolio to gold or Bitcoin as a hedge against U.S. debt and inflation.

“The U.S. is entering a debt doom loop,” he said, referencing Treasury forecasts of $12 trillion in new debt within the next year.

Dalio noted that while Bitcoin remains volatile and faces regulatory questions, its role as a store of value is becoming harder to ignore.

You May Also Like

BNB Holders Can Now Earn Daily Passive Income Through the Officially Launched BNB Payment Integration by Find Mining

One address lost over $900,000 due to a phishing approval signed 458 days ago