Crypto market hits widest institutional-retail investor split since 2023 in H1 2025: Wintermute

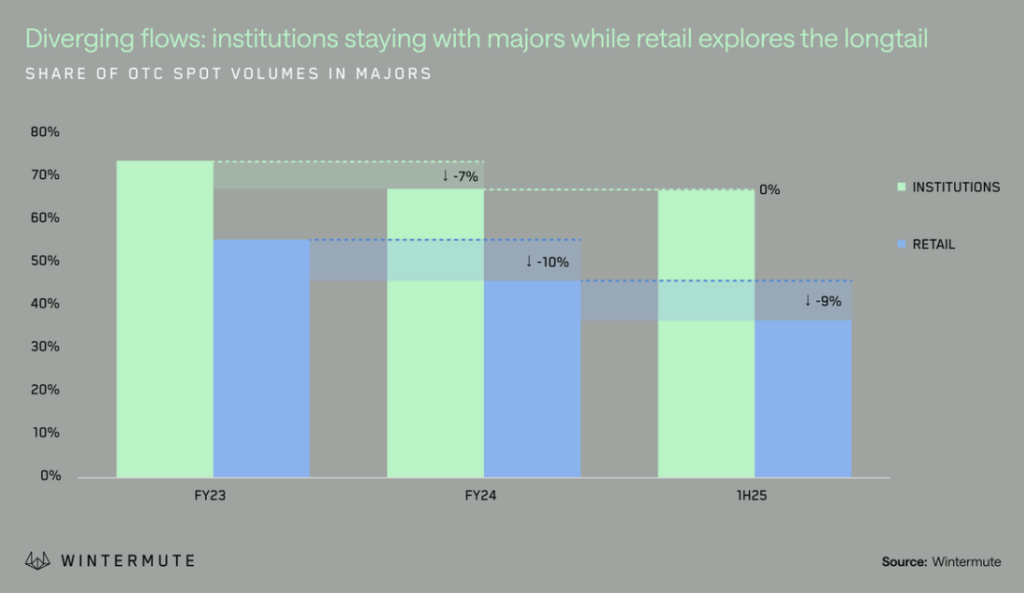

In the first half of 2025, crypto market has seen its widest divergence in investor focus since 2023, with institutions doubling down on majors while retail pivots to altcoins.

According to Wintermute’s 1H 2025 OTC Market Report, institutions have doubled down on Bitcoin (BTC) and Ethereum (ETH) in the first half of this year, maintaining a hefty 67% allocation to these two assets. In contrast, retail investors have pulled back sharply, dropping their combined BTC and ETH holdings to just 37%, as they increasingly shift focus toward altcoins.

Wintermute described the trend as “the widest divergence since 2023 and a clear break from earlier parallel moves.”

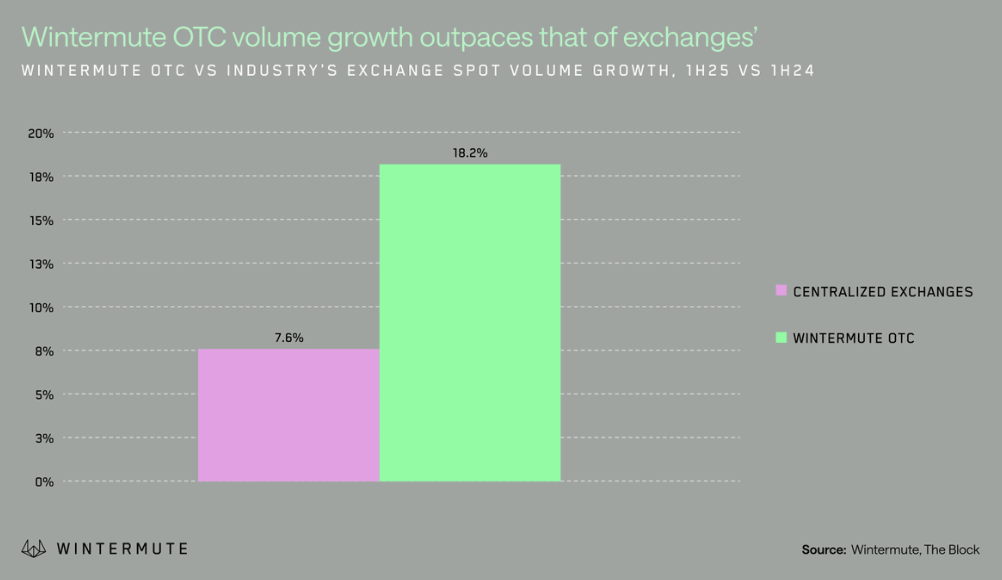

Beyond portfolio allocations, institutional adoption is reshaping crypto trading dynamics. According to the report, OTC trading volumes have surged to grow 2.4 times faster than CEX volumes in the first half of this year, driven by institutional players seeking large, discreet trades without exposing assets on exchanges.

“Counterparties continue to seek efficient ways to execute larger trades, and as institutional participation grows, there’s a rising preference to trade without the need to hold assets on exchange platforms,” Wintermute wrote.

The report also noted a 412% jump in options trading centered on BTC and ETH, compared to the first half of 2024, alongside a twofold increase in traded CFD underlyings, including newly launched index products.

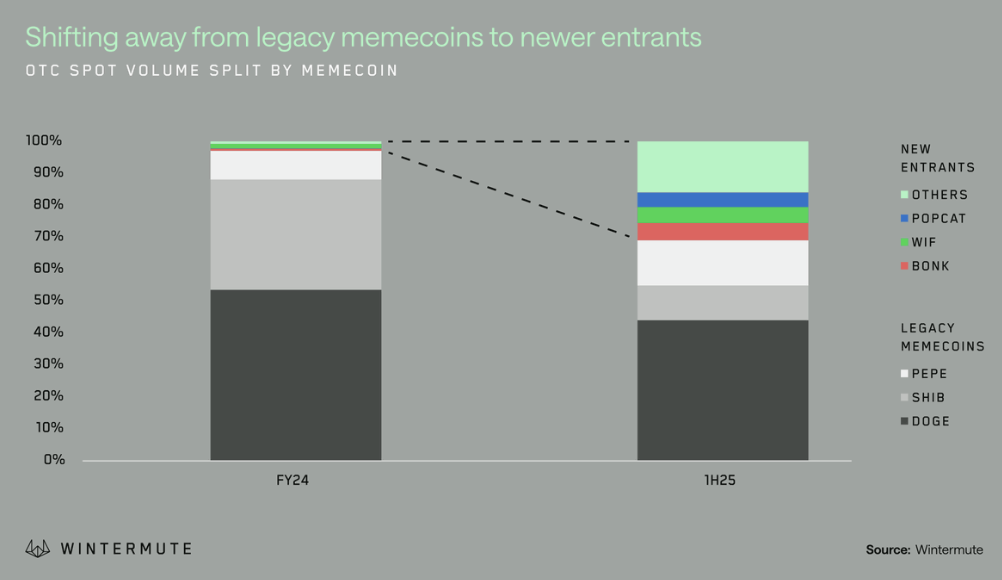

Wintermute’s report shows that legacy memecoins like Dogecoin (DOGE) , Shiba Inu (SHIB), and Pepe Coin (PEPE) lost ground to newer entrants like Bonk (BONK), Dogwifhat (WIF), and Popcat (POPCAT). As a result, the share of long-tail memecoins surged dramatically, rising from 0.7% to 16.1% of total trading flow.

You May Also Like

Aethir and Credible launch first DePIN-powered crypto credit card

Dow Jones up on bank earnings as Trump denies plans to fire Powell