Aster Price Prediction – Low Cap Crypto Explodes 457%

Aster (ASTER), a cryptocurrency powering an exchange for decentralized perpetual contracts, has gone up by triple digits in a single day. Currently trading above the $0.47 mark, the utility crypto has surged by over 457% in the last 24 hours.

The surge in Aster’s price recently has led the community to ask whether the momentum will continue or if a major drop-off may be coming soon. This article gives a proper forecast, both short term and long term, for the Aster price, before providing insight into another crypto with similar potential.

Aster Price Surges By Triple Digits: Will It Explode Further?

Following the launch of Aster on Aster Spot after the token generation event, the price of the token has surged at an unprecedented level, though this is expected for a token that has just been listed.

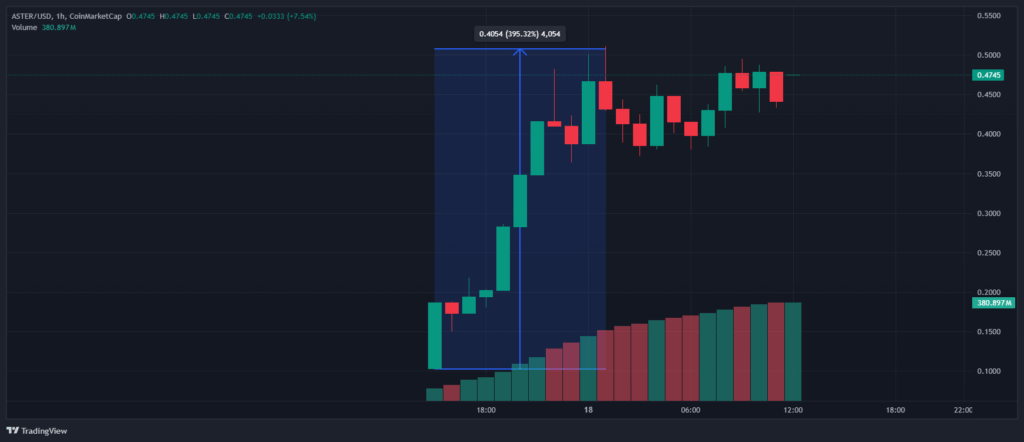

https://twitter.com/Aster_DEX/status/1968595875573407935The hourly charts show that the Aster price has now started to consolidate around the $0.47 level after a surge of more than 400%.

The reason behind this price action is clear: listing. This means it is unlikely that the momentum will hold. However, Aster is powering a decentralized perpetual exchange. Among traders, this could be a strong utility that provides the token with long-term upside.

What is Aster?

Aster is the native crypto of Aster DEX, a decentralized exchange for perpetual contracts. According to the website, the DEX allows users to trade stocks cross-chain and with hidden orders.

It has upwards of 2 million users already, according to its claims, and its trading volume is more than $516 billion.

Among all the perks the platform offers, the “invisible order” feature seems to be its biggest advantage. Hidden orders reportedly let users place limit orders that remain fully hidden from the public order book. This method of anonymous trading is suitable for many investors who want to keep their crypto trades private.

It also supports spot trading and portfolio management. Aster features a reward hub with its own “Trade and Earn” program, along with competitions, all of which give the project an engaging look that could translate to long-term gains for Aster investors.

Aster Price Prediction: Short-Term and Long-Term

Since the Aster token has gone live only recently, users need to be very careful, as much of the growth seen today could be corrected within the next few days. Based on these factors, here are the short-term and long-term price predictions for the token.

Short-Term Price Prediction

In the short term, investors could expect the Aster token to rise further. However, the excitement of the listing pump is over, which can already be seen on the hourly charts. Investors now have only minor upticks to rely on, bolstered by social media posts and competitions. After a while, however, the cryptocurrency’s price could correct. The degree of correction will depend on macroeconomic conditions.

Long-Term Price Prediction

In the long term, Aster’s use cases will play a key role in determining how the token performs on the price chart. Much will depend on the level of traction the decentralized exchange is able to gain. If it attracts more customers, newcomers may also want to explore the advantages that holding the Aster token provides.

The bottom line is that it is difficult to give a reliable long-term price forecast for Aster because the token has only just entered the market. Its price action will depend on both macroeconomic conditions and the project’s own use cases.

Best Wallet Token is Another Crypto with Similar Potential

Much of the traction Aster has gained is because Aster DEX has already been an active product. This is evident from its reported 5 million users and more than $516 billion in daily volume.

However, the listing gains are gone. For those still seeking early gains, Best Wallet Token is worth considering.

Best Wallet Token is the cryptocurrency that powers Best Wallet, an already-active wallet supporting more than 90 blockchains. Thanks to enhanced security features powered by Fireblocks MPC technology, along with cross-chain swaps and multi-chain functionality, Best Wallet Token has managed to amass a large following. It has even gained attention from the New York Post, which named it a top cryptocurrency app.

The token is an integral part of the ecosystem, offering users additional perks such as increased staking rewards, discounts when buying crypto, and community governance. Best Wallet Token’s unique benefit is also access to a launchpad, which allows users to buy presale cryptos while they are still at the 0 stage.

The Best Wallet ecosystem has also gone through multiple updates recently, including the addition of Solana blockchain support, Bitcoin swaps, and a gamified system that rewards users for simply opening the app.

Best Wallet Token has also been one of the most popular cryptos to buy in presale. The presale has raised close to $16 million already, and analysts have said it has 100x potential.

Visit Best Wallet Token

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

The Channel Factories We’ve Been Waiting For

SOLANA NETWORK Withstands 6 Tbps DDoS Without Downtime