Trade Without Listings: Coinbase Introduces Solana DEX Trading

Coinbase has added Solana DEX trading inside its app as the company expands on-chain tools to become an “everything app”.

Coinbase has pushed deeper into Solana by adding native decentralised trading inside its app.

The update lets users swap Solana tokens directly on-chain without waiting for listings. The move follows a stretch of community criticism and comes as Solana’s trading activity reaches new highs.

Coinbase expands Solana DEX trading access

Coinbase activated native Solana DEX trading inside its mobile application. This means that users can now swap Solana tokens directly on-chain and settle trades using USDC or other supported payment options like bank transfers or debit cards.

The update completes a promise made after Coinbase added DEX support for Base-network assets in August.

The company also signalled that Solana would follow before year-end. Andrew Allen, a Coinbase protocol specialist, confirmed the rollout and said users will soon see Solana assets appear inside the app.

He added that issuers no longer need to wait for listings as long as their tokens hold enough liquidity. This means that developers can gain exposure to millions of Coinbase users once the DEX identifies the token on-chain.

Solana becomes a larger part of Coinbase’s long-term plan

Coinbase is building toward what it calls an “everything exchange.” The company wants to merge custodial trading and on-chain activity into one platform and Solana now sits at the centre of that effort.

Earlier this month, Coinbase revealed plans to acquire Vector, an on-chain trading platform built for Solana. The deal is expected to close by year-end and Coinbase intends to plug Vector’s tools into its DEX systems.

For some context, Vector specialises in identifying new Solana assets as soon as they deploy on-chain or launch through early liquidity platforms.

Coinbase believes these tools will help traders find new assets more quickly and discover better liquidity across the chain.

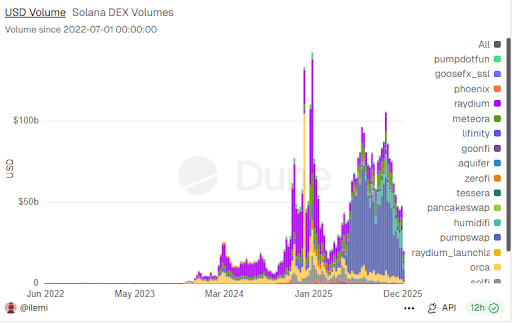

Solana DEX volume has been especially strong this year | source: Dune Analytics

Solana DEX volume has been especially strong this year | source: Dune Analytics

Solana DEX volume rose above $1 trillion this year alone, and data shows more than $4 billion in 24-hour trading volume. This is alongside nearly $94 billion over the past month.

Platforms like HumidiFi, Pump, Meteora, Raydium, Orca and Tessera V hold most of that activity and account for more than 88% of daily trades.

Related Reading: Whale Accumulation Drives Solana Price Towards $200 Target

Solana community reacts to Coinbase’s Base–Solana bridge

Coinbase faced strong feedback from the Solana community after launching a Base–Solana bridge in early December.

The bridge uses Chainlink’s Cross-Chain Interoperability Protocol and allows users to move SPL assets into Base and use them in apps built for Base.

Base lead Jesse Pollak described the bridge as a two-way route that helps unlock shared liquidity.

Solana co-founder Anatoly Yakovenko pushed back, arguing that bridges capture value rather than act as neutral infrastructure.

He urged Base developers to move computation toward Solana if they expect tighter economic alignment.

Members of the Solana Foundation also raised worries about how the bridge was launched.

They said it bypassed their technical and marketing teams and did not include a Solana-based partner for the initial release.

Pollak replied that the bridge followed nine months of development.

He said builders on both chains had requested the connection and observers noted that Coinbase carried out similar outreach strategies when expanding toward Ethereum builders earlier in the year.

The post Trade Without Listings: Coinbase Introduces Solana DEX Trading appeared first on Live Bitcoin News.

You May Also Like

Now You Don’t’ New On Streaming This Week, Report Says

Pakistan’s Bitcoin Pivot Sparks Momentum for DeepSnitch AI, Up 80% In Presale