ASTER Tanks 22% as Key Support Breaks: What’s Next?

ASTER is trading at around $0.74 after falling over 22% over the last seven days. The drop continued with an 8% decline in the past 24 hours.

Consequently, the recent swap occurred after a noticeable technical failure as the price dumped below its important support area of $0.85 to $0.9. The selling pressure was high all through the week, and there has not been any recovery yet.

Breakdown Confirms Downtrend

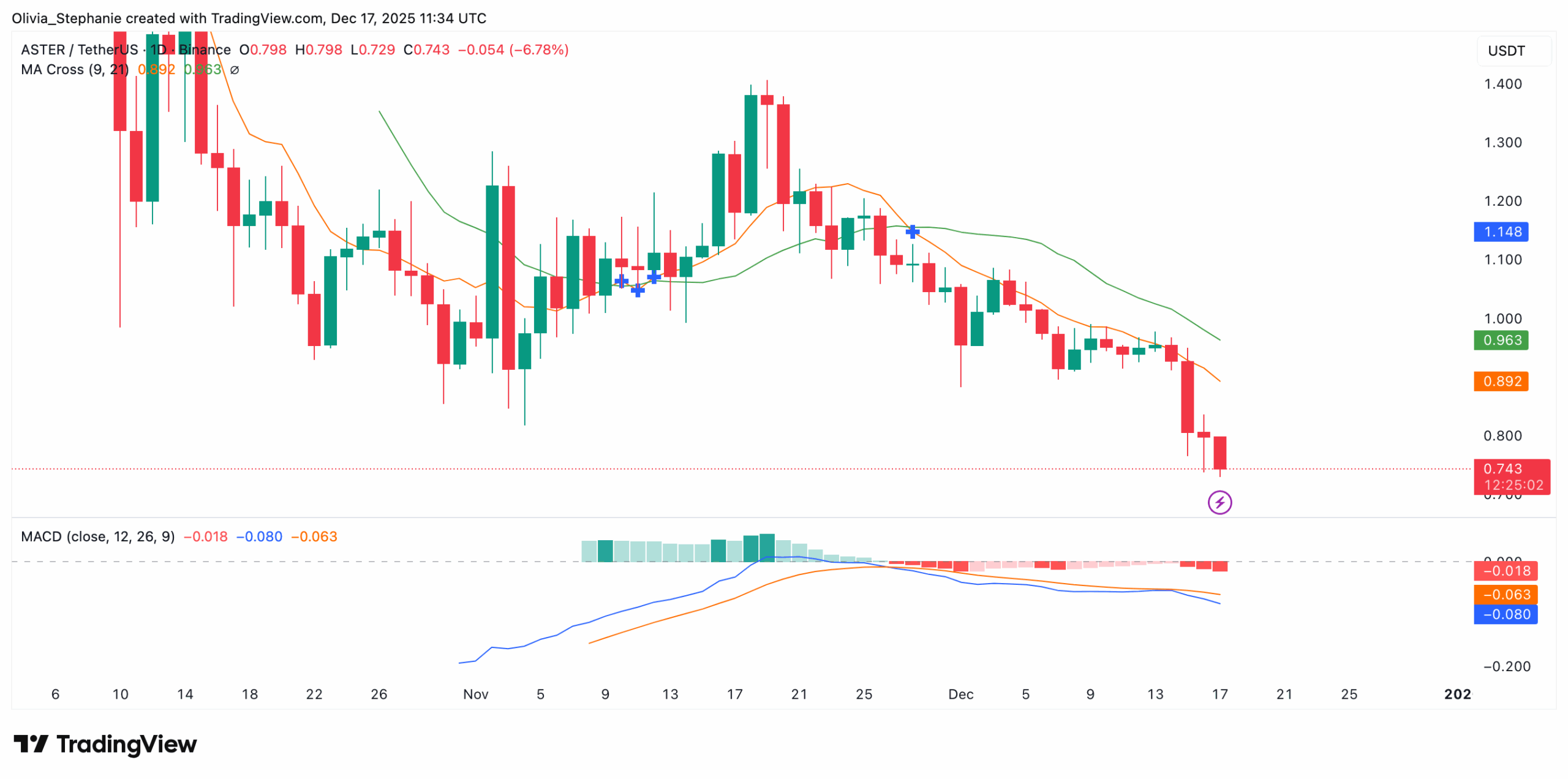

The chart shows a steady pattern of lower highs over several weeks, with a descending trendline guiding the move down. That trend ended with the support level breaking cleanly, without any strong rebound or wick.

Cirus described the move as a “textbook breakdown,” adding, “That wasn’t panic selling. That was acceptance of lower prices.” The post warned that any short-term bounce should not be mistaken for a reversal, saying “Bounces ≠ reversals in broken structure.” The trend remains in place until strength returns above the former support.

Meanwhile, ASTER trades well below both the 9-day and 21-day moving averages. The 9-day MA is now at $0.89, while the 21-day is at $0.96. A bearish crossover confirms continued downside pressure.

The MACD also remains negative. The MACD line is at -0.080, with the signal line at -0.063. The histogram is widening to the downside. Momentum is still pointing lower, with no signs of divergence or recovery.

ASTER Price Chart 17.12. Source: TradingView

ASTER Price Chart 17.12. Source: TradingView

In addition, futures open interest has dropped to $420 million, down from over $600 million in November, per CoinGlass data. This decline came as the price declined and suggests traders are exiting positions.

The data reflects lower participation rather than panic. Volume has not surged, and the move appears to show traders stepping back rather than rushing out. The price and open interest falling together often signal lower conviction in the market.

Product Launch and Whale Accumulation

On December 15, Aster DEX introduced Shield Mode. The new feature offers up to 1001x leverage, instant execution, and no slippage. It also includes off-book trading and one-tap long or short orders.

However, whale wallets remain active. BeingInvested reported high-volume accumulation over the past 24 hours. “Massive inflow into $ASTER,” the post said, listing top buyers, including one purchase of 1.34 million tokens valued over $1 million.

The post ASTER Tanks 22% as Key Support Breaks: What’s Next? appeared first on CryptoPotato.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

Optum Golf Channel Games Debut In Prime Time