ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

39175 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

U.S. Treasury Rules Out BTC Buys as GOP Senators Push For Use Of Gold Reserves

2026/02/05 04:35

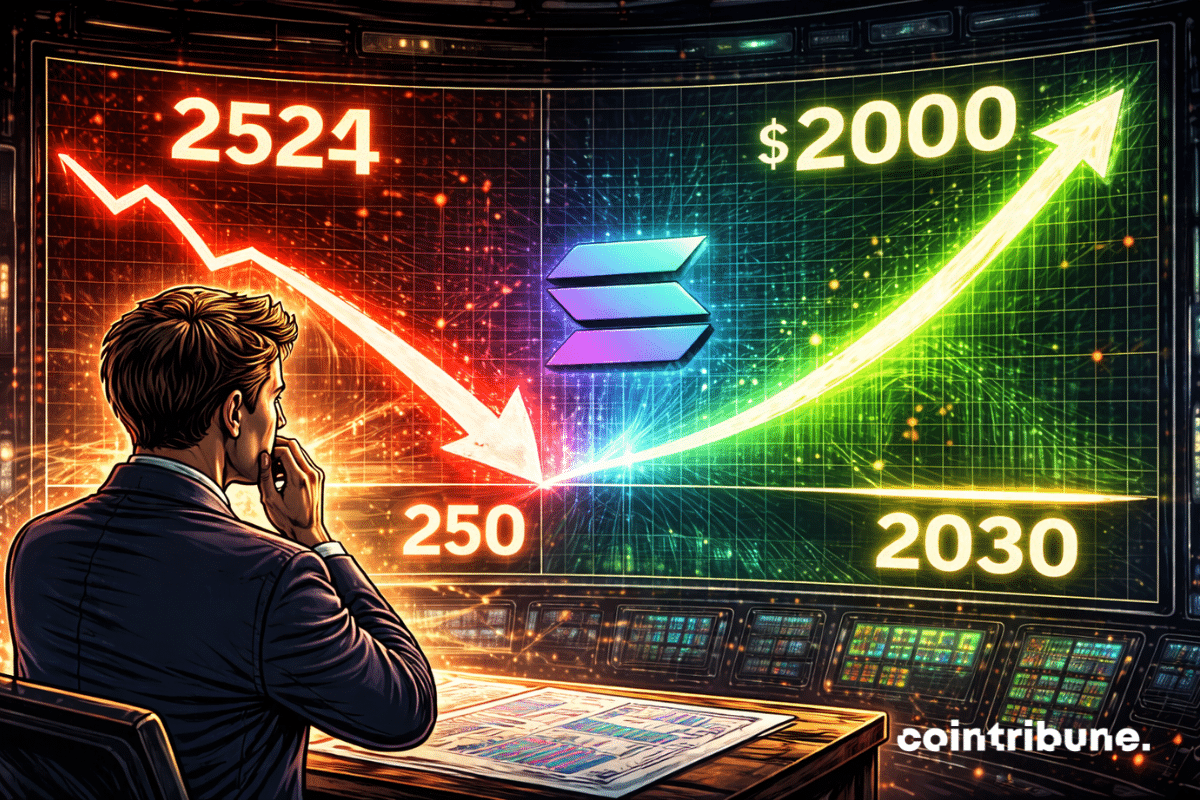

Solana To Hit $250 In 2026 ? Bank Explains Why

2026/02/05 04:05

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

2026/02/05 04:00

This is Trump's plot to rig the midterms — we must unite to beat it

2026/02/05 03:57

Over 80% of 135 Ethereum L2s record below 1 user operation per second

2026/02/05 03:52