Launchpad

Share

Launchpads are decentralized platforms that facilitate early-stage fundraising for new Web3 projects through Initial DEX Offerings (IDOs). They provide investors with curated access to token sales while offering startups a community-driven capital injection. In 2026, launchpads have evolved into full-stack incubators, focusing on project quality and long-term sustainability. Follow this tag for the latest in token distribution models, tier-based participation, and the emergence of the next generation of "unicorn" protocols across various blockchain ecosystems.

2934 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Top 10 NFT Development Companies for 2026

Author: Medium

2025/09/30

Share

Hoe gaat het altseason van 2025 eruit zien?

Author: Coinstats

2025/09/30

Share

Recommended by active authors

Latest Articles

Trend Research still holds approximately 290,000 ETH, having sold 170,000 ETH in the past 10 hours.

2026/02/06 18:32

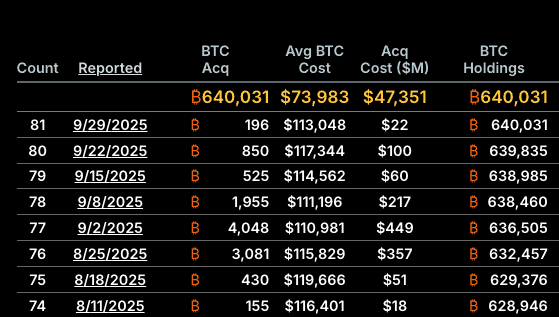

Strategy to initiate a bitcoin security program addressing quantum uncertainty

2026/02/06 18:21

Republic Europe Offers Indirect Access to Kraken IPO

2026/02/06 18:02

Solana Foundation’s Lily Liu urges focus on finance as crypto prices slide

2026/02/06 17:57

Rising Altcoins Capture Attention in a Bearish Market

2026/02/06 17:48